Unlock Agility, Intelligence, and Seamless Banking Experiences

The financial industry is at a turning point – constrained by legacy systems, regulatory complexity, and soaring expectations for hyper-personalized experiences. Traditional banks struggle with rigid infrastructures, while fintech disruptors navigate scalability and compliance hurdles.

To compete, institutions must adopt AI-driven, composable architectures to enable rapid product launches, enable seamless integrations, and power intelligent automation. The next era of financial services belongs to those who embrace agility and evolve at pace with market and technology evolution.

Key Industry Challenges

- Legacy Systems Slow Innovation → 80% of IT budgets go to maintenance, limiting innovation.

- Customers Demand AI-Powered Personalization → 73% of banking customers expect real-time, AI-driven interactions.

- Regulatory Complexity Rising → Compliance costs have grown by 60% over the last decade, pressuring financial institutions.

- Payments & Embedded Finance Growth → Real-time payments and API-led banking are becoming standard.

Industry Stats

Projected AI savings in banking risk and compliance by 2030

Faster go-to-market for financial products with composable architecture.

Reduction in operational costs from AI-driven automation.

Decrease in customer service costs with AI-powered engagement.

Our Solution

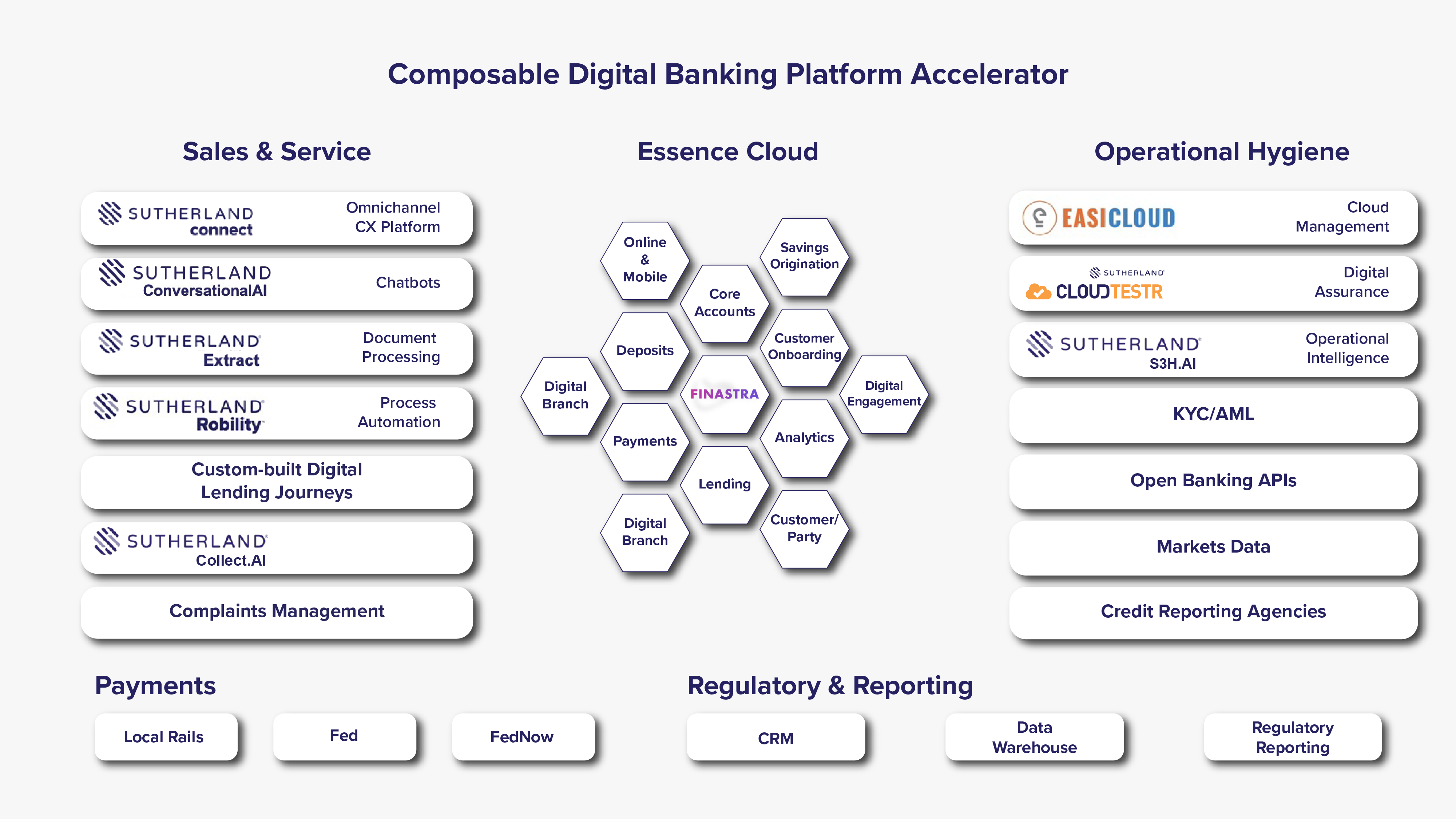

Sutherland’s AI-powered Composable Digital Banking Platform enables rapid banking transformation with a modular, API-first architecture and AI-powered automation.

Composable Core Banking

Seamlessly integrates with Finastra, enabling modular, cloud-native banking services.

AI-Driven Customer Experience

Conversational AI and hyper-personalized engagement via WhatsApp, mobile, and digital channels.

Regulatory Compliance & Risk

Embedded FinScan KYC/AML and Regnology reporting automation.

Payments & Embedded Finance

Real-time transactions via FedNow, Trustly, Worldline, and local rails.

Automation & Process Intelligence

AI-powered process automation, document processing, and fraud detection.

Unlocking Digital Performance

40-60% Cost Savings

Reduce IT and operational costs with automation & cloud efficiencies

50% Faster Go-To-Market

Deploy new products & services at digital speed

AI-Powered Personalization

Deliver hyper-relevant, real-time customer experiences

Seamless API-First Integrations

Plug-and-play connectivity with core banking, fintechs, and third-party solutions

Compliance at Scale

Stay ahead of regulatory changes with automated risk & reporting solutions

Data-Driven Decisioning

AI-powered insights to drive revenue, reduce risk, and enhance CX

Segments We Serve

Sutherland’s AI-powered composable platform is designed for diverse banking segments, helping institutions accelerate innovation, efficiency, and compliance.

Retail & Consumer Banking

Cards & Payments

Fintechs & Neobanks

Capital Markets & Investment Banking

Commercial Banking

Credit Unions

Platforms

Powering innovation for your digital transformation journey

Omnichannel CX Platform for AI-driven banking experiences.

Sutherland ConnectAI-powered chatbots and virtual agents for seamless self-service.

Sutherland Conversational AIDocument automation for KYC, underwriting, and compliance workflows.

Sutherland ExtractProcess automation for fraud prevention, claims processing, and lending.

Sutherland RobilityCore banking & composable financial services integration.

Cloud management and digital assurance for scalable banking.

EASICloud & CloudTestrKey Leaders