Underwriting has always been about evaluating risk with rigor and judgment. But in today’s data-saturated, tech-enabled landscape, the fundamentals of underwriting are being reshaped. Data volumes are exploding, submission flows are surging, and underwriting teams are being asked to move faster with fewer resources—all while complexity climbs.

According to Everest Group, more than 50% of underwriters’ time is still spent on low-value tasks like data entry, clearance, and manual follow-ups¹. HFS Research reports that 63% of insurers cite increasing underwriting complexity as their top barrier to profitable growth².

In this environment, the Chief Underwriting Officer (CUO) is no longer just the steward of risk appetite. Their role is evolving fast. They are becoming a data leader, a tech enabler, and a strategic orchestrator across the underwriting value chain. Gartner forecasts that by 2027, 60% of underwriting decisions will be augmented by adaptive AI systems—not static business rules³. The CUO who succeeds now must think like a data scientist—interrogating information, connecting systems, and operationalizing insight.

Because underwriting today is not just about assessing risk. It’s about engineering an intelligent, connected enterprise that can scale underwriting advantage.

Underwriting Isn’t Broken. It’s Bottlenecked.

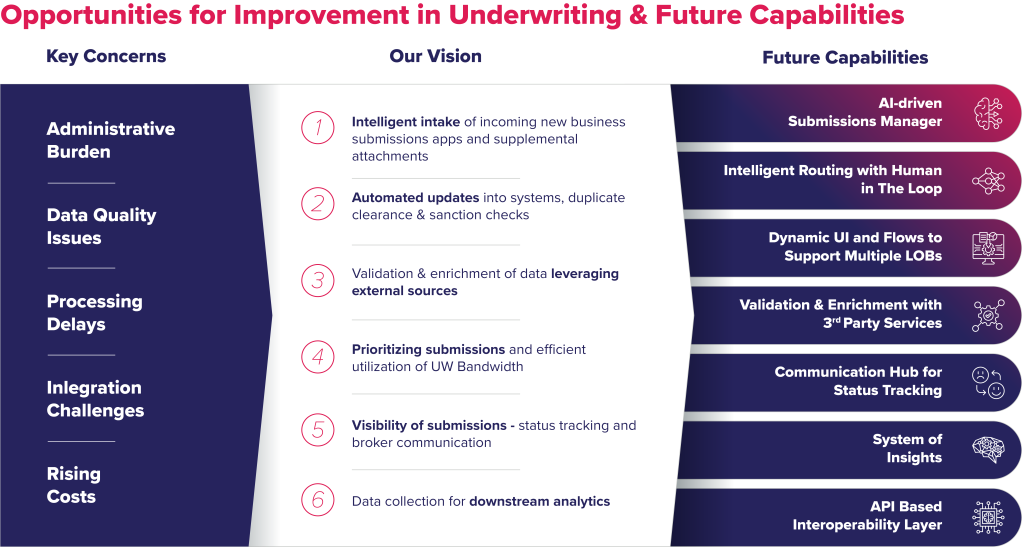

Across the industry, carriers are feeling the squeeze. Manual submissions, inconsistent triage, fragmented systems, and underwriter bandwidth constraints are choking growth. According to Everest Group, more than half of underwriters’ time is still spent on administrative and low-value tasks like intake, rekeying, and email follow-up[4]¹.

This inefficiency translates directly into lost business:

- Delayed quotes that drive brokers elsewhere

- Missed appetite fit due to first-in, first-out models

- Inaccurate pricing from incomplete or poor-quality data

- Underutilized underwriter capacity from poor triage

And with risk complexity rising—from climate to cyber to evolving commercial property exposures—the cost of slow, disconnected underwriting is growing.

Why Thinking Like a Data Scientist Matters

A modern data scientist thrives on signal over noise. They design systems that learn, adapt, and scale. For CUOs, that mindset is critical—because commercial underwriting is no longer about isolated decisions. It’s about connected intelligence across the full lifecycle.

1. AI-Led Submission Triage and Prioritization

In commercial lines, the volume of submissions has outpaced the capacity to respond. AI can now assess submissions at ingest—evaluating completeness, appetite fit, and win probability. Leading carriers are using Agentic AI, like Sutherland’s triage engine, to classify and prioritize submissions in real time, improving throughput and driving better hit ratios[5]².

When every submission looks the same, underwriters spend time on the wrong deals. When triage is guided by AI, the right submissions reach the right underwriter—fast.

2. Connected Intake to Decision

Data entry isn’t just tedious—it’s costly. Ingesting PDFs, ACORD forms, and broker emails manually introduces friction, delay, and error. With connected underwriting, that intake can be automated. Sutherland’s AI-led platform drives 80%+ automation at intake and guarantees 99.9% data accuracy, feeding enriched, structured data directly into downstream systems[5]².

This transforms the underwriter experience—from rekeying to reasoning.

3. Real-Time Decision Intelligence

Thinking like a data scientist also means enabling portfolio-aware underwriting. Modern platforms give CUOs visibility into where capacity is deployed, where risk accumulates, and how individual decisions affect broader targets.

Tools like Sutherland’s underwriting cockpit help underwriters see how each decision aligns with appetite, authority, and business goals. AI isn’t replacing human—it’s augmenting them with contextual insight.

The New CUO: Architect of a Connected Underwriting Enterprise

CUOs are under increasing pressure to deliver more—with greater speed, precision, and profitability. But they’re not alone—they just need the right operating model. This is where connected underwriting becomes the foundation.

A connected approach integrates the full value chain:

- Smart intake: AI reads, classifies, and clears submissions automatically

- Triage intelligence: Risk signals and win potential are evaluated at ingest

- Decision support: Underwriters are guided by real-time appetite and portfolio context

- Integrated workflows: Systems and data are stitched together without rip-and-replace

In one example, a specialty commercial carrier working with Sutherland reduced new business data entry time from 25 to 7 minutes, increased underwriter speed-to-quote by 90%, and achieved a 3% improvement in expense ratio through automation and orchestration[5]².

This is not a transformation for the sake of transformation. It’s underwriting designed for profitable growth.

Leading the Change: Where CUOs Should Focus Now

If you’re a CUO today, the message is clear: you don’t need to become a data scientist—but you mustneed to lead like one. That means:

- Champion data quality from the start—what’s not standardized can’t be scaled

- Operationalize triage with AI-driven appetite and win scoring

- Insist on decision transparency in AI and model logic

- Break silos across intake, risk, pricing, and servicing workflows

- Design feedback loops that let your team learn from every bind and loss

And most importantly—build an underwriting organization that can evolve as fast as the risk landscape does.

Final Word: From Judgment to Intelligence

Risk selection will always be an underwriter’s craft. But the CUO’s job is no longer to just defend that craft—it’s to elevate it. Thinking like a data scientist doesn’t mean coding algorithms. It means being accountable for how your organization ingests, interprets, and acts on data—at every level.

In the new world of commercial underwriting, expertise is table stakes. Intelligence is the differentiator.

And the CUO who can connect both will define what underwriting leadership looks like in 2025 and beyond.

To learn more about connected underwriting in the age of AI, visit our solution center or schedule an expert briefing!

References

- Everest Group. Digital Underwriting: How to Drive Intelligence and Speed Across the Underwriting Life Cycle, 2025

- HFS Research. Insurance Horizons 2025: Reinventing Risk with AI and Data

- Gartner. Top Strategic Technology Trends in Insurance, 2025

- Everest Group. Digital Underwriting: How to Drive Intelligence and Speed Across the Underwriting Life Cycle, 2022

- Everest Group. Next-Gen Underwriting: Accelerating Value with AI and Automation. 2025.

- HFS Research. Top 10 Trends in Insurance 2025.

- Gartner. Top Strategic Technology Trends in Insurance: 2025 Edition.