Key Points

- AI is shifting collections from reactive recovery to proactive prevention.

- Predictive insights and personalization drive better engagement and outcomes.

- Sutherland’s 6,000+ collectors and AI-powered platform enable end-to-end modernization.

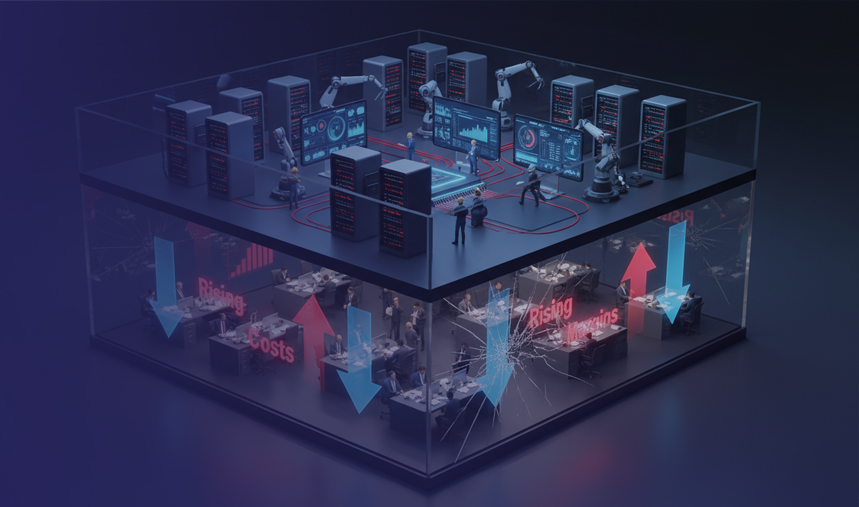

The collections function in banking is undergoing its biggest transformation in decades. What was once a reactive, manual process is becoming a proactive, data-driven discipline — powered by artificial intelligence.

In the U.S., where household debt has surpassed $17 trillion and delinquency rates are on the rise, banks are reevaluating their approach to engaging customers in financial distress. According to McKinsey, institutions using AI in credit and collections are seeing up to 30% better customer satisfaction and faster recoveries. The message is clear: AI isn’t just helping collect — it’s helping connect.

What Has Changed in Banking Collections?

Historically, collections in banks and lenders operated on a “delinquent account → contact → negotiate/resolve or charge-off” model. The approach was largely reactive, one-size-fits-all, and labor- intensive.

Today, several shifts are forcing a rethink:

- The complexity and volume of credit assets, and the diversity of consumer behaviour.

- Digital channels and changing customer expectations: borrowers expect flexible, personalised communication and faster resolution.

- Regulatory pressures (especially in the U.S.) demanding fairer treatment of borrowers, transparency, and audit-ready processes.

- Data availability: banks now have richer behavioural, transactional and external data to fuel segmentation and proactive strategies.

These changes mean that collections must be smarter, faster and more customer-centric.

The 3 Pillars of the New Science of Collections:

Predict, Personalize, Prevent

To succeed in this transformed environment, banks should orient their collections strategy around three interlinked pillars: Predict, Personalize, and Prevent.

Predict

This involves using data and analytics to identify accounts at risk, pinpoint when the risk is highest, and determine which channels or approaches are most likely to be effective. Rather than waiting for “30/60/90 days past due”, banks leverage machine-learning models to forecast delinquencies, flag accounts at risk of being ‘trouble’ and prioritize outreach appropriately.

Personalize

Once risk is identified, the next step is tailoring the engagement: by channel (SMS, email, voice, app), by timing (when the borrower is most responsive), by message content (based on the borrower’s profile, history, behavior). Personalization moves collections from “you owe us” to “we understand your situation and are offering the right solution”.

Prevent

Perhaps the most transformative pillar: shifting from only reacting to troubled accounts to preventing them from deteriorating in the first place. That means early-warning, nudging customers, offering alternative repayment paths, or reallocating risk earlier in the lifecycle. Preventive collections treat collections not just as cost recovery, but as value-preserving, customer-retaining activity.

How AI is Driving Collections

McKinsey calls collections “the new customer experience frontier.”Banks that embed AI into collections will not only recover more but also preserve relationships and reputation — especially important under tighter CFPB scrutiny.

Here’s how you can map AI to enable each of the above pillars:

Predict

AI turns collections into a forward-looking discipline. By analyzing behavioral, transactional, and contextual data, banks can flag at-risk accounts weeks before delinquency. Machine-learning models score the likelihood of default, recommend outreach timing, and rank accounts based on risk-to-value potential. Predictive insights help teams focus effort where it matters most—preventing surprises and enabling data-driven resource allocation.

Personalize

Once risk is identified, AI enables personalized, empathetic engagement. It tailors tone, message, and channel based on customer history and behavior—text for digital natives, phone for high-touch borrowers, app notifications for on-the-go users. Generative AI can craft dynamic scripts and offers, while adaptive learning refines what works in real time. This turns collections from a compliance conversation into a trust-building one.

Prevent

AI helps banks move from recovery to prevention. Continuous monitoring detects subtle stress signals—missed micro-payments, unusual spending, or reduced engagement—and triggers early nudges or repayment options. Next-best-action engines suggest self-service plans or outreach before delinquency escalates. The goal isn’t chasing late payments—it’s keeping customers financially healthy and preserving lifetime value.

Key Implementation Considerations & Pitfalls: AI in Collections

Transforming collections into this “new science” is not without challenges. Here are key areas to address:

- Data & Infrastructure – Banks must manage data pipelines, integrate payment history, transaction behaviour, external data, channel engagement logs. Poor data maturity means AI initiatives stall.

- Operating Model & Scale – McKinsey notes institutions with highly centralized gen-AI operating models progressed to production faster (≈70 %) compared to those with decentralized models (≈30 %). That suggests collections groups must align strategically, not just bolt on tools.

- Human + Machine Balance – Automation is powerful—but human judgement remains essential (especially in high-touch cases, regulatory oversight, and complex negotiations).

- Compliance, Ethics & Consumer Experiences – Regulation in the U.S. is increasingly active. For example, the U.S. Department of the Treasury’s 2024 AI in Financial Services report noted that nearly 78 % of institutions are using generative AI for at least one use case—and emphasized the need to manage risks such as bias, data privacy, and third-party oversight. In collections, the risk of perceived aggressive practices, unfair treatment, or inadequate disclosure is high.

- Change Management & Culture – The shift from ‘collections as cost recovery’ to ‘collections as value-preservation + customer engagement’ requires cultural change. Mindset is critical: banks must see AI as more than cost-cutting tools.

Conclusion

The collections function in U.S. banking is undergoing a fundamental shift. No longer simply a cost-recovery backstop, it is becoming a strategic lever—powered by AI, repositioned around the Predict-Personalize-Prevent framework. By moving earlier in the lifecycle, tailoring engagement, and intervening proactively, banks can control credit risk, deepen customer relationships and reduce operational cost. AI is the enabler: it allows banks to move from “who is delinquent?” to “who might become delinquent and what should we do about it—and when?” Yet technology alone is not enough: success demands data quality, operational scale, governance, human-machine integration and a culture that accepts collections as value-preservation rather than purely loss-mitigation.

For banks in the U.S., the time is now. With rising credit risk, digital-first borrowers, and cost-pressures squeezing margins, using AI to transform collections is no longer optional—it’s imperative.

Sutherland’s Collections Proposition

Sutherland’s Collections solution is built on the same Predict–Personalize–Prevent philosophy—powered by AI, analytics, and human expertise. With 6,000+ skilled collectors, 20+ years of domain experience, and over $4 billion in annual collections, Sutherland helps leading banks and lenders modernize their recovery operations end-to-end. From pre-delinquency prevention and early-stage engagement to late-stage recovery and post-resolution analytics, we bring a unified, AI-driven platform along with services that improves outcomes, protects customer relationships, and drives sustainable business impact.