The Urgency to Converge

Legacy platforms can’t keep pace with modern financial crime risks. Limited AI means they miss complex fraud rings, generate excessive false positives, and rely on inefficient manual workflows. The result—slower investigations, higher costs, and greater exposure to regulatory risk.

Sutherland FRAML (unified Fraud, risk and AML solution) delivers an AI-led Financial Crime Compliance (FCC) platform with advanced analytics, real-time monitoring, and automation—closing compliance gaps and helping institutions stay ahead of evolving threats and regulatory scrutiny.

Industry Trends in Financial Crime

In fines levied over 3 years for AML/fraud compliance gaps (ACAMS, 2024)

YoY increase in fraud attacks; mobile fraud up 4x (PYMNTS, 2024)

Of all fraud losses now stem from synthetic identities (McKinsey, 2023)

BFS firms are actively converging AML and Fraud systems (Gartner, 2024)

YoY increase in compliance costs, especially for mid-market FIs (Gartner, 2025)

Sutherland FRAML Delivers Measurable Impact

Reduction in payment fraud losses

Increased Regulatory compliance & reduced fines

Improved CSAT & reduced onboarding abandonment

Reduction in false positives

Increase in remediation speed & analyst efficiency

Sutherland FRAML Solution Overview

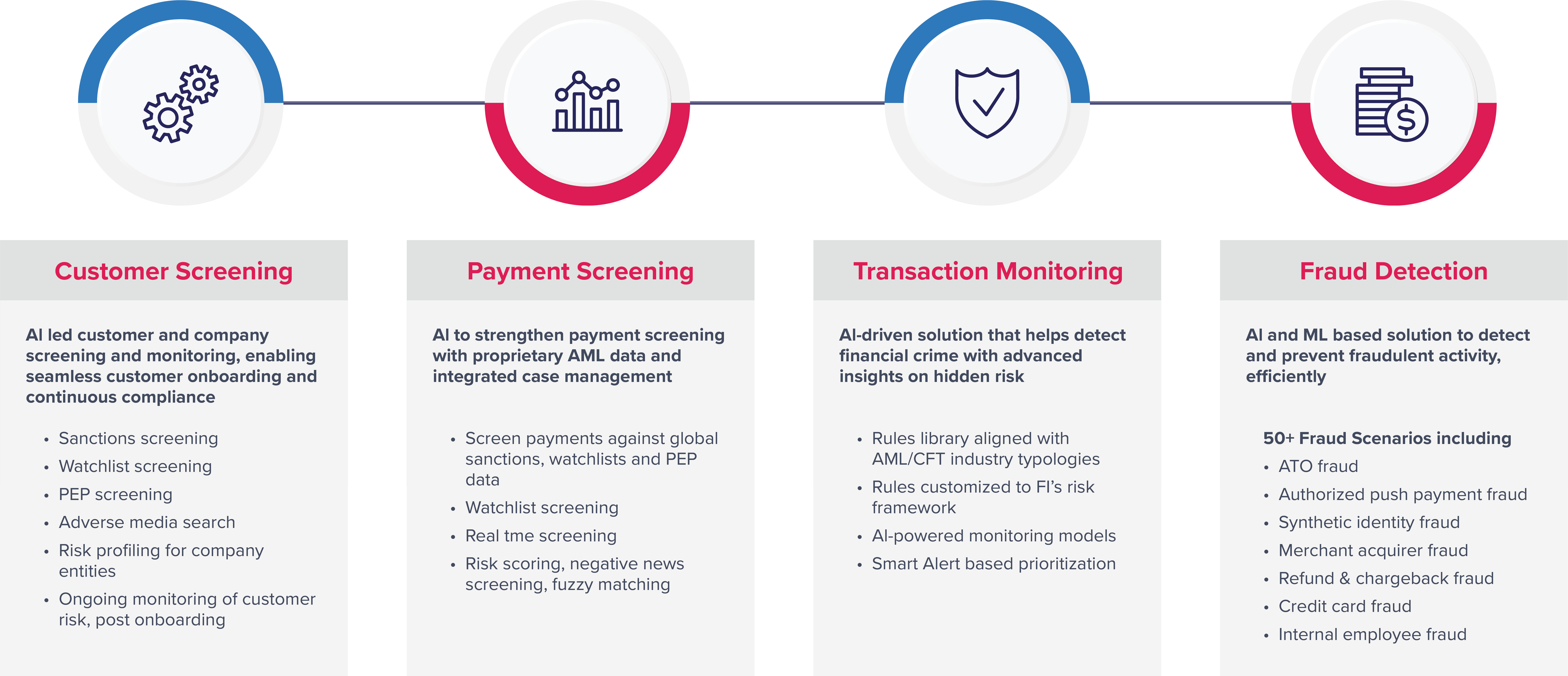

Sutherland FRAML delivers a unified risk, fraud and AML compliance platform that connects customer screening, real-time transaction monitoring, and alert resolution—wrapped in modular managed services.

Backed by 2,400+ domain SMEs (subject matter experts) and AI accelerators like Agentic AI, Sentinel AI, and HelpTree, the solution handles everything from onboarding and watchlist screening to alert triage and SAR (Suspicious Activity Report) filings.

Highlights

End-to-end

FRAML risk management

Comprehensive Platform

With real-time data, smarter detection, and faster remediation

AI/ML Models

& Agentic AI covering 50+ fraud scenarios including ATO, APP, Synthetic ID etc

What Makes Sutherland FRAML the Industry Standard

Comprehensive Solution

FRAML platform, AI/analytics, FCC operations CoE, digital accelerators, and advisory

Unified Compliance Stack

With Sentinel AI (Real-time PII masking and breach protection) Security and Agentic AI Alert Decisioning

Unparalleled Access to Partner Ecosystem

Across KYC, KYB, Core Banking, and Business Intelligence

Analyst Recognitions

What Our Clients Say

Who we Serve

Retail & Consumer Banks

Reduce alert remediation time, modernize onboarding, cut fraud losses

Consumer Lenders

Cards & Payments

Commercial Banks

Fintechs & Credit Unions

Our Experts