AI in Insurance You Can Trust.

Decisions You Can Explain.

Personal Lines

Commercial Lines

Life & Annuity

Group Benefits

From Front to Back Office—AI that Transforms Insurance with Trust and Velocity

Insurance Value Chain Supercharged

Real-world use cases powering speed, trust, and impact, at every step: underwriting, claims, servicing, and more…

Agentic Workflows

Seamless Benefits Enrollments

Connected Underwriting

Smarter, Faster Decisions

Claims Adjudication

Accelerated Outcomes

Knowledge AI

Shorter Learning Curves

Document AI

Fast-Track Auto Claims

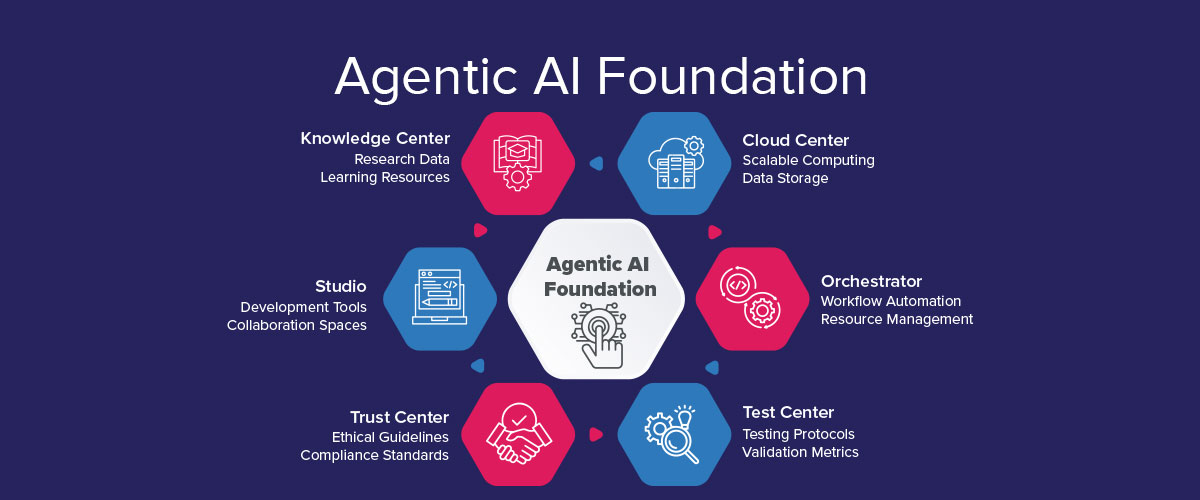

AI Agents That Are Built For Action

One Suite. Every AI Platform You Need

Sutherland AI Insurance Hub is Built to Last

Insurance Demands Trust. We Deliver It.

Secure Data Residency

Sensitive insurance data including customer PII, claims, and policies remain within your secured environment.

Granular Access Control

Role-Based Access Control and least-privilege principles enforce authorized access to data and model outputs.

Zero Retention Model

Third-party foundation models like OpenAI and Azure operate in zero retention mode; data is never stored.

Automated Redaction & PII Masking

Sensitive identifiers such as names, SSNs, and account numbers are masked before any AI interaction.

Auditability & Traceability

Every AI prompt, decision, and output is logged and auditable for regulatory and governance purposes.

Custom Compliance Guardrails

HIPAA, PCI-DSS, SOC 2, and state insurance laws are embedded into your AI workflows.

Private Model Hosting

Private fine-tuning and deployment supported within your VPC, air-gapped center, or secure cloud tenancy.

Red Teaming & Adversarial Testing

Continuous red teaming simulates attacks and vulnerabilities, proactively securing AI before deployment.

Get in Touch with Our Experts