“Sutherland’s GTM for the segment is centered around a CX-led approach, supported by its TPA capabilities and a suite of digital tools and accelerators.” – Everest Group, PEAK Matrix® Assessment 2025

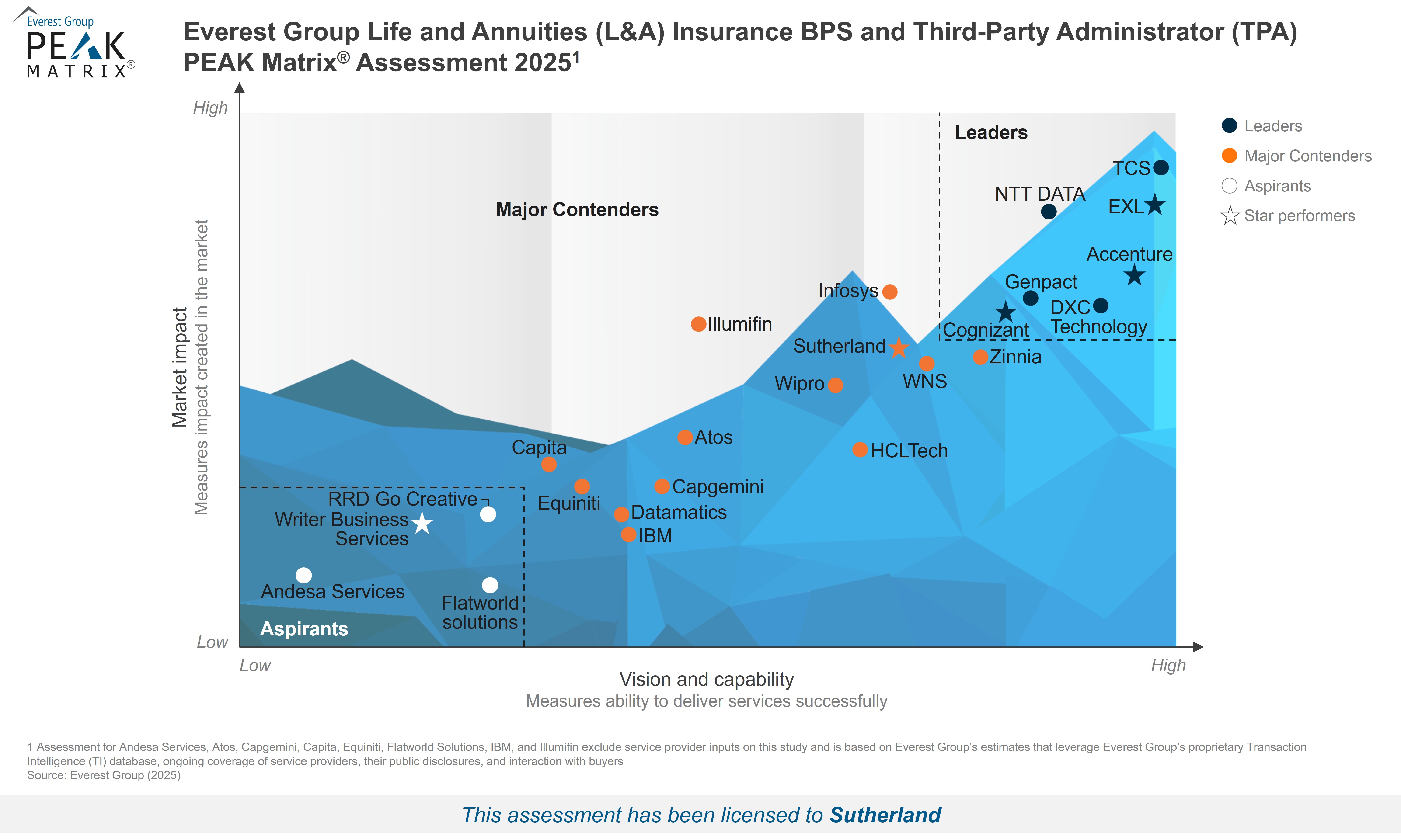

Sutherland has been named both a Star Performer and Major Contender in the 2025 PEAK Matrix® for Life and Annuities (L&A) Insurance BPS and Third-Party Administration (TPA) services by Everest Group. We’re one of the only seven providers with a revenue growth rate exceeding 15%!

This recognition underscores our ongoing investments in scalable digital platforms, experience-led transformation and high-growth areas such as claims and absence management for group life.

Highlights from the Report

- Recognition for High-Impact Innovation: Advanced AI-led automation, conversational AI, and Extract.ai-based intake automation

- Robust Capabilities in Group Life: Specialized solutions in absence management and licensed-agent sales processes

- Omnichannel, Digital-Enabled Claims Transformation: Hyper-personalized journeys with a mobile app for complex claims intake

- Comprehensive Coverage: Life, Annuities, and Benefits (Individual and Group) Lines of Business across the value chain

Why This Recognition Matters

- Digital-First TPA Capabilities – Sutherland has redefined L&A TPA services by combining omnichannel experience, policy servicing, and claims transformation using automation, AI, and proprietary digital platforms.

- Strong Market Momentum – Everest Group cites strong revenue growth and multiple client additions across North America, including partnerships with Fortune 500 insurers

- Platform-Led Innovation – Solutions like Sutherland TPA Edge, Sutherland CognilinkClaims, Digital Beneficiary Management and CX360 reflect our focus on end-to-end digitization and customer-centric transformations

- High-Impact Use Cases – We support carriers across policy acquisition, claims, contact center operations, and administration of open and closed blocks with white-glove service capabilities

Why Sutherland?

Policies under administration

Improvement in sales conversion through direct-to-consumer programs

Digital containment across contact center operations

Improvement in return-to-work outcomes via intelligent absence management

Faster claims resolution through automation and smart intake

Transactions processed across the policy, claims, and service lifecycle

About the Report

Everest Group’s 2025 Life and Annuities (L&A) Insurance BPS and TPA PEAK Matrix® evaluates 24 providers based on market impact, vision, and capability. The report reflects insurers’ rising demand for digital-first transformation and platform-led service models.

Get Access to the Everest Research

Sutherland has exhibited notable growth in the Life & Annuities (L&A) Insurance BPS and TPA market, underpinned by its CX-led strategy, robust TPA capabilities, and a comprehensive portfolio of digital tools and accelerators. This integrated approach has solidified Sutherland’s position as a preferred partner for enterprises. Sutherland has strengthened its capabilities through the deployment of a comprehensive suite of solutions, including Cognilink, its digital TPA suite, and CX360. Furthermore, it has strategically expanded its digital ecosystem by forging key platform partnerships with LIDP, Newgen, and LexisNexis. Collectively, these efforts have positioned it as a Major Contender and Star Performer in the Everest Group Life and Annuities (L&A) Insurance BPS and Third-Party Administrator (TPA) PEAK Matrix® Assessment 2025.”

– Sahil Chaudhary, Practice Director, Everest Group.