For financial institutions, 2025 is not just another cycle. Fee income is eroding, credit losses are ticking up and customers are comparing their banking experience to the best of Big Tech. Every CXO knows the playbook: cut costs, push digital, tighten risk.

.

In a recent Everest Group survey of over 220 global BFS enterprises, firms found that while budgets are increasing for “modernization, cybersecurity, AI, and financial crime & compliance (FCC)”, these firms are still struggling with operational inefficiencies.

But here’s the uncomfortable truth — you can’t tech your way out of structural pressures without first fixing the fundamentals of customer experience and operating discipline.

The Real Pressure Points

1. Revenue Pressure That Feels Permanent

Banks have leaned on fees and balance sheet growth for too long. Today, with customers migrating to digital channels, the challenge isn’t cost reduction — it’s revenue relevance. Forrester’s US Multichannel Banking Total Experience Score Rankings 2025 shows many multichannel banks are losing ground — brand promises aren’t resonating, and CX continues to decline. If digital journeys aren’t designed to create value, they become highways to commoditization.

| 👉 The CXO challenge: How do you monetize digital touchpoints without making them feel transactional? |

2. Delinquencies Rising, Collections Strained

Credit card and consumer loan delinquencies are rising toward levels not seen since 2019. Collections teams are caught between regulatory scrutiny and the need to bring costs down. Chasing late payments with the same old scripts isn’t enough.

| 👉 The CXO challenge: How do you turn collections from a reactive cost into a proactive trust-building function? |

3. Customer Experience as the Weak Link

Banks love to talk digital, but customers still feel the friction — inconsistent service across channels, long wait times and disjointed problem resolution. Forrester’s Total Experience Score in 2025 for multichannel banks finds declines in both Brand Experience (BX Index™) and Customer Experience (CX Index™) for many major banks. Customer trust is eroded when promises don’t match delivery. NPS and CSAT scores don’t just reflect customer frustration; they reveal systemic weaknesses in how banks are run.

| 👉 The CXO challenge: How do you align CX with operational performance so every interaction strengthens loyalty instead of eroding it? |

4. Technology Debt Slowing Down Transformation

Most banks have multiple “modernization” initiatives underway — but too many pilots stall at proof-of-concept. CIOs aren’t short on technology; they’re short on velocity. HFS’s 2025 Outlook for BFS signals that tech debt and infrastructure strain are among the top concerns, particularly for collection and servicing functions which require resilience under volume spikes. Without integrating new tools into the operating core, investments in cloud, automation or AI will always fall short.

| 👉 The CXO challenge: How do you go from experimentation to enterprise-grade change without losing resilience? |

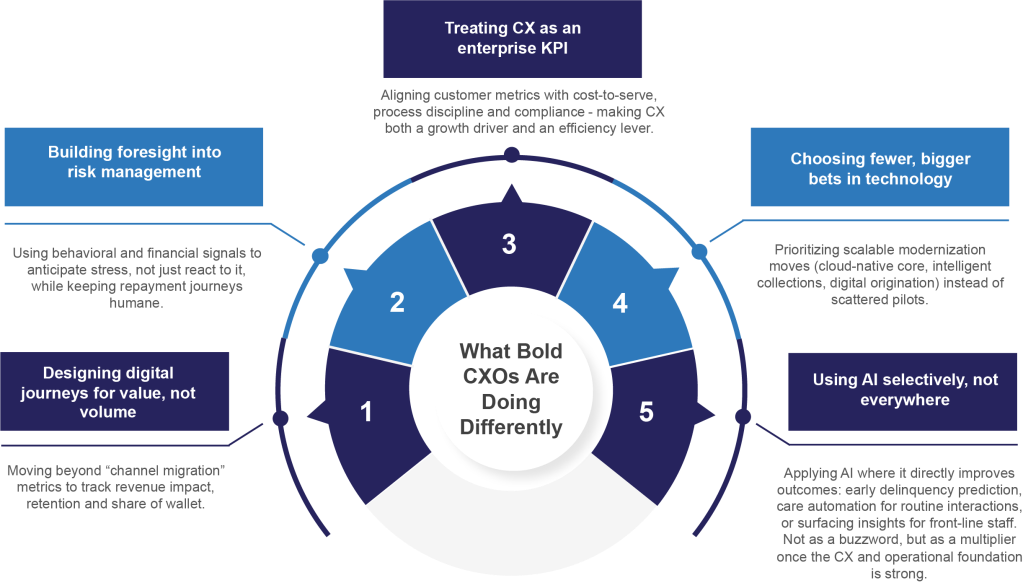

What Bold CXOs Are Doing Differently

- Designing digital journeys for value, not volume – Moving beyond “channel migration” metrics to track revenue impact, retention and share of wallet.

- Building foresight into risk management – Using behavioral and financial signals to anticipate stress, not just react to it, while keeping repayment journeys humane.

- Treating CX as an enterprise KPI – Aligning customer metrics with cost-to-serve, process discipline and compliance — making CX both a growth driver and an efficiency lever.

- Choosing fewer, bigger bets in technology – Prioritizing scalable modernization moves (cloud-native core, intelligent collections, digital origination) instead of scattered pilots.

- Using AI selectively, not everywhere – Applying AI where it directly improves outcomes: early delinquency prediction, care automation for routine interactions, or surfacing insights for front-line staff. Not as a buzzword, but as a multiplier once the CX and operational foundation is strong.

Closing Thought

The future of banking won’t be won by who has the flashiest app or the biggest AI lab. It will be won by CXOs who can balance growth, risk, and transformation with discipline — modernizing where it matters most, fixing CX before layering on new tech, and deploying AI where it makes a measurable difference.

That path may not sound glamorous. But it’s the difference between chasing trends and building a bank that stays relevant — and profitable — for the next decade.

About Sutherland

Sutherland partners with more than 80 of the world’s leading banks and financial institutions, including top-tier retail, commercial and digital-first players across the globe. With over 35 years of BFS domain expertise, we help clients reimagine customer experience, modernize risk and compliance and accelerate digital transformation. Our AI-enabled platforms and BPaaS delivery models consistently deliver measurable outcomes — from 35% reduction in TCO, 30% TAT reduction in back office ops to double-digit improvements in NPS and collections effectiveness.