As rising consumer debt, regulatory scrutiny, and changing borrower expectations reshape the financial services landscape, collections can no longer operate as a reactive recovery function. This whitepaper explores how leading lenders are redefining collections as a strategic customer experience capability grounded in empathy, personalization, and trust.

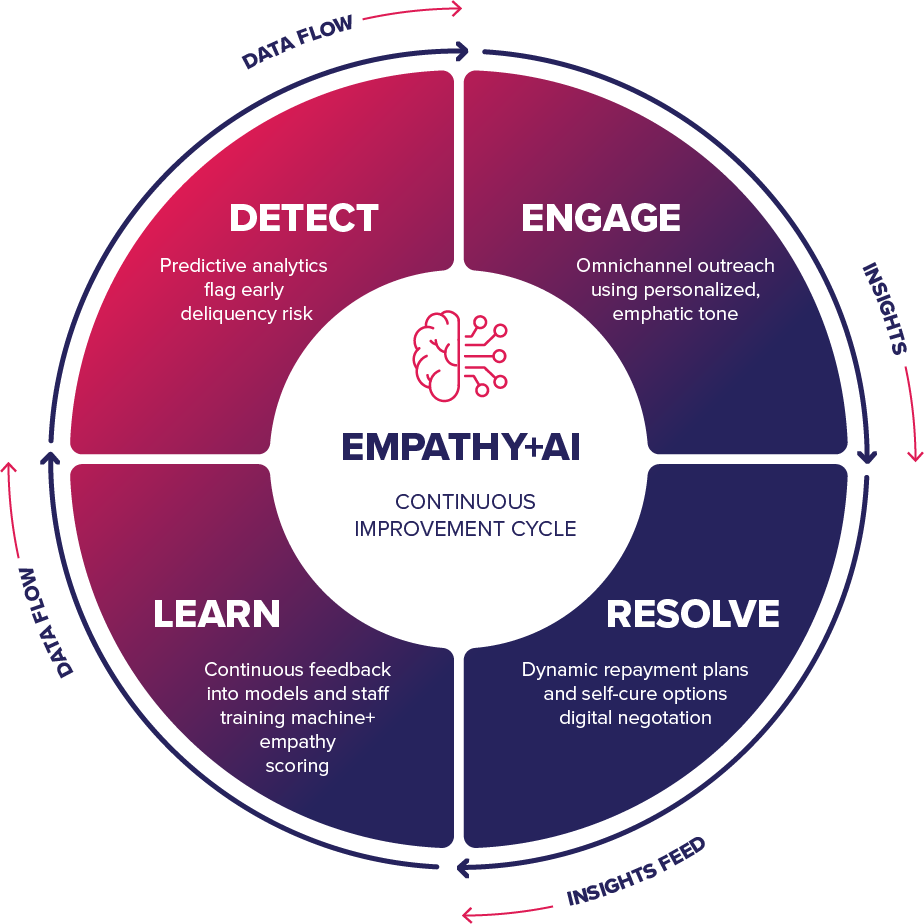

Drawing on industry research and real-world case spotlights, the whitepaper outlines how Agentic AI, predictive analytics, and digital self-service models enable lenders to intervene earlier, personalize engagement at scale, and reduce cost-to-collect while improving customer outcomes. It introduces the Human-Digital Collections Maturity Model to help institutions benchmark their journey from manual, compliance-led operations to AI-orchestrated, relationship-driven ecosystems.

In this whitepaper you will unlock:

- The shift from debt recovery to relationship management

- How Agentic AI enables predictive, empathetic, and compliant collections

- Designing digital self-cure and loss mitigation journeys

- Case examples demonstrating measurable gains in efficiency, recovery, and CX

- A future outlook on ethical, sustainable, and digital-first collections

Reinvent Collections with AI, Empathy, and Digital Trust