Key Takeaways

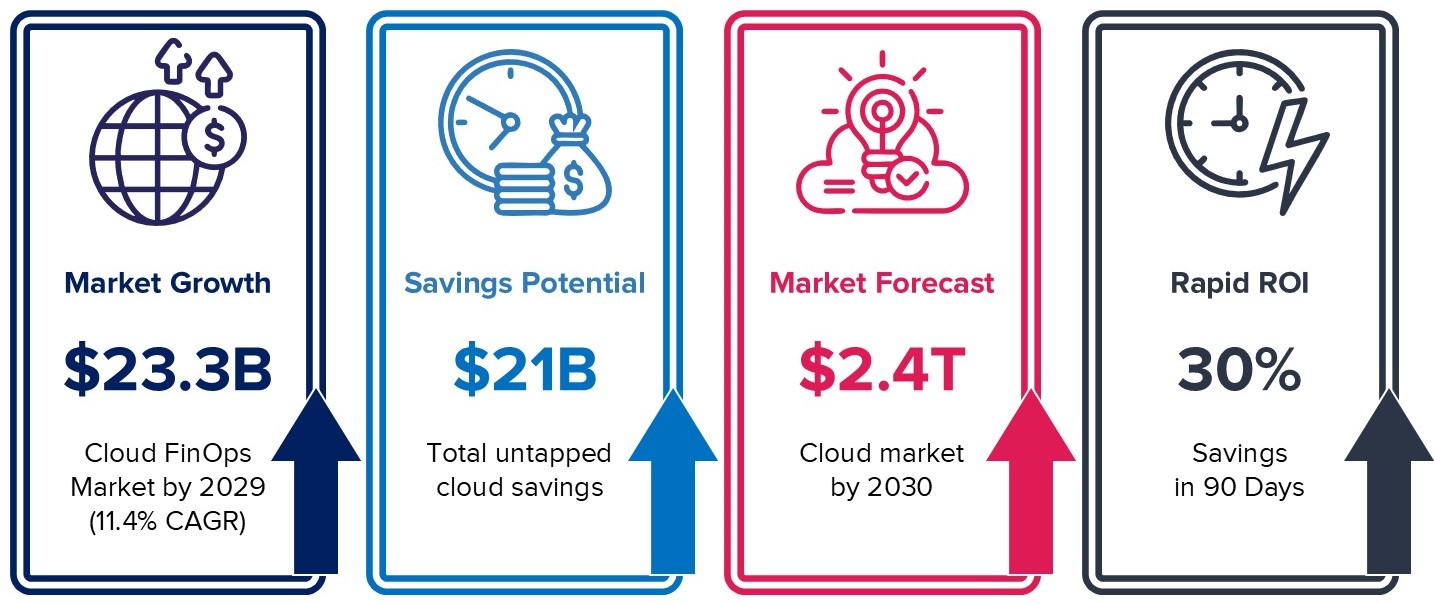

- Cloud FinOps is a $23.3 billion market (projected by 2029) with 11.4% annual growth driven by multi-cloud adoption, AI/ML workload acceleration, and regulatory mandates

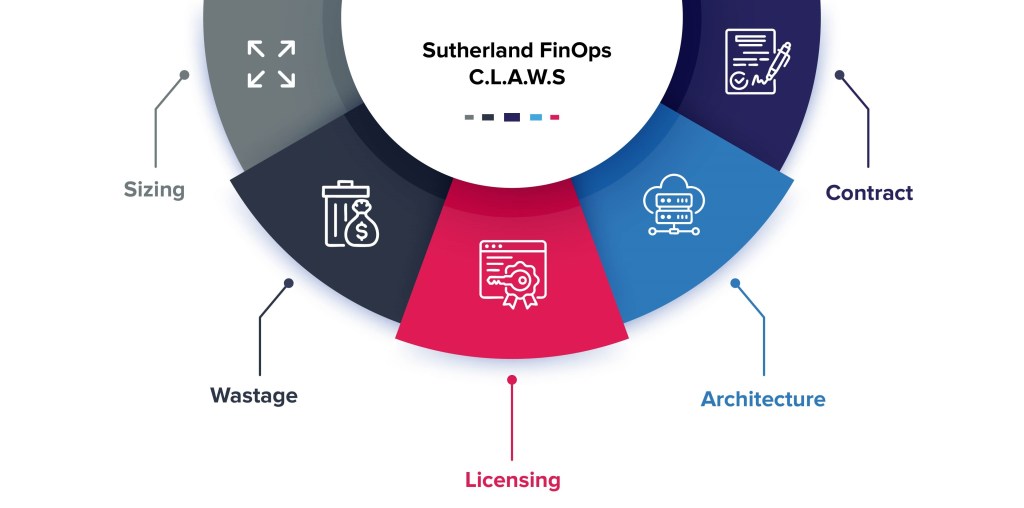

- Sutherland C.L.A.W.S approach to FinOps – Integrating Contract, Licensing, Architecture, Wastage & Sizing as primary pillars for FinOps management

- Organizations are leaving $21 billion in potential savings on the table through inefficient cloud financial management

- AI/ML-powered FinOps delivers ~30% cost savings within 90 days while improving governance, compliance, and operational agility

- Success requires unified visibility, proactive optimization, and embedded governance, not just tools, but organizational alignment and sustained commitment

- Sutherland’s FinOps-as-a-Service model combines advanced technology, automation, and human expertise to deliver faster results and lower risk

Enterprises are scaling their cloud footprints faster than ever, but many still struggle to explain, predict, and control their cloud spend. The challenge is real: multi-cloud architectures, exploding AI workloads, and rising regulatory pressure have turned cloud financial management into a board-level concern rather than a back-office task.

The numbers tell the story. Valued at approximately $723 billion in 2025, the global cloud market is on track to reach $2–2.4 trillion by 2030. Within this explosive growth, the Cloud FinOps market itself is expanding rapidly—from $13.5 billion in 2024 to $23.3 billion by 2029 (an 11.4% compound annual growth rate). Some forecasts project the market could reach $38 billion by 2034.

Yet despite this investment in cloud infrastructure, most enterprises are leaving money on the table. Deloitte estimates that organizations could save $21 billion in 2025 alone through better FinOps practices. Cloud bills often exceed forecasts by 20–40%, and 87% of enterprises report difficulty in allocating and attributing cloud costs across their environments.

This blog walks through the key steps organizations must take toThis blog walks through the key steps organizations must take to evolve FinOps into a strategic advantage, powered by frameworks like Sutherland’s C.L.A.W.S (Contract, Licensing, Architecture, Wastage & Sizing), a holistic approach that optimizes cloud spend across financial and technical dimensions. By integrating commercial contracts, licensing efficiency, architectural choices, resource wastage, and right-sizing, C.L.A.W.S shifts enterprises from reactive cost control to proactive, AI-driven financial governance that delivers measurable savings while aligning investments with business outcomes and compliance. It shows how unified visibility, predictive intelligence, and embedded governance work together to unlock sustained cost savings, improve control, and ensure cloud spend directly supports business priorities. evolve FinOps into a strategic advantage, showing how unified visibility, predictive intelligence, and embedded governance work together to unlock sustained cost savings, improve control, and ensure cloud spend directly supports business priorities.

Step 1: Gain Unified, Real-time Visibility Across your Cloud Estate

The foundation of effective FinOps is a single, trusted view of cloud spend across all providers, accounts, and business units. Yet most organizations rely on fragmented, tool-specific dashboards that create visibility gaps and slow decision-making.

Sutherland’s Cloud FinOps solution delivers:

- Unified cost analytics dashboard across AWS, Azure, GCP, and OCI with key FinOps KPIs such as cost efficiency score, budget efficiency ratio, and spend trending

- Workload-level visibility that supports chargeback, showback, and regulatory reporting for industries such as banking, insurance, and healthcare

- Multi-dimensional filtering by business unit, department, project, environment, and cost allocation tags

- Real-time alerts on spend anomalies and budget overages before they become quarter-end surprises

With this visibility, CFOs, CIOs, and FinOps leads can finally answer critical questions in real time: Who is spending what, where, and why? Which departments or projects are driving cost growth? Are we within budget? What are our cost drivers by resource type?

This unified view is especially important for regulated industries. A BFSI institution Sutherland worked with needed workload-level cost attribution to satisfy regulatory audits and internal chargeback requirements. By implementing Sutherland’s cost analytics with proper tagging governance, it achieved 32% cost reduction while maintaining audit compliance and improving accountability across business units.

Step 2: Use AI/ML to Predict, Detect Anomalies, and Automate Optimization

Traditional cloud cost reports are backward-looking and manual. By the time you see the spike in your monthly bill, the overages have already occurred. AI-powered FinOps makes optimization continuous, proactive, and increasingly automated.

Sutherland applies AI/ML models to:

- Forecast cloud spend with 95%+ accuracy so finance teams can plan budgets with confidence and predict seasonal or growth-driven cost patterns

- Detect anomalies in near-real-time using advanced statistical models that identify unusual resource provisioning, increased consumption, or unexpected workload behavior

- Recommend rightsizing opportunities that typically unlock approximately 30% cost savings within the first 90 days through VM resizing, reserved instance optimization, spot instance adoption, and scheduling idle resources

- Rationalize licenses by comparing actual consumption vs. contracted entitlements and recommending downsizing or consolidation

- Manage AI/ML workload costs through dedicated optimization for rapidly growing GenAI and large language model expenses—the fastest-growing segment in cloud spending (63% of FinOps teams now track AI costs, up from 31% in 2024)

These insights are operationalized through automation, reducing manual effort from cloud and DevOps teams by up to 70% and accelerating time-to-value.

A large US telecom operator needed to control costs while scaling its DevOps infrastructure to support rapid service delivery. Sutherland automated the deployment of 400+ Spring Boot microservices on AWS EKS, applied Infrastructure as Code for secure provisioning, and embedded FinOps practices to continuously optimize AWS costs. The result: 30% cloud cost savings, 67% improvement in deployment agility, 40% better scalability and performance, and a security posture score of 8/10—with continuous quarterly savings of 5% achieved through rightsizing and serverless containerization.

Step 3: Embed FinOps into Cloud and DevOps Operations

Technology and analytics alone are not enough; FinOps principles must be embedded into day-to-day engineering and operations practices. This requires organizational alignment, governance frameworks, and integration into existing CI/CD and infrastructure workflows.

Sutherland supports this through:

- FinOps-as-a-Service model with a dedicated Optimization Operations Center staffed by FinOps engineers, cloud architects, and financial analysts

- Governance frameworks for tagging compliance, budget controls, policy enforcement, and chargeback across multi-cloud environments

- Integration into CI/CD and Infrastructure-as-Code workflows so that cost, performance, and security are addressed together during development and deployment

- Monthly optimization reviews and governance updates to ensure sustained cost reduction and compliance

- FinOps AI Consultant support for strategic guidance on cloud financial strategy and governance maturity progression

This operating model helps organizations shift from reactive clean-up (addressing bills after overruns occur) to proactive design-for-cost (considering cost implications during architecture and development decisions).

Key Challenges Enterprises Face on their FinOps Journey

Even with strong tools and experienced partners, enterprises should plan for several recurring FinOps challenges:

- Aligning stakeholders around shared KPIs – Finance, IT, and product teams often speak different languages. Establishing shared FinOps KPIs (cost efficiency score, budget variance, cost per transaction) requires executive sponsorship and organizational alignment.

- Establishing reliable data quality and tagging governance – Accurate cost allocation depends on consistent, comprehensive tagging of cloud resources. Many organizations underestimate the effort required to enforce tagging standards at scale.

- Governing rapidly growing AI/ML and container workloads – AI and containers are accelerating cloud cost growth, but these workload types often lack cost visibility and governance. Proactive AI cost management is essential.

- Avoiding tool sprawl – Many organizations accumulate multiple FinOps and cost management tools, creating silos and inconsistent reporting. Integrating FinOps capabilities into existing cloud and DevOps ecosystems is more effective than adding isolated tools.

- Translating technical recommendations into business outcomes – Engineering teams may be reluctant to implement cost optimization recommendations if they perceive conflicts with performance or feature delivery. Frame FinOps as enabling faster, cheaper innovation rather than constraining development.

- Sustaining momentum beyond the initial POC – Many FinOps initiatives lose steam after the initial proof of concept. Long-term success requires operational discipline, continuous improvement, and ongoing executive sponsorship.

Addressing these challenges early through organizational alignment, governance frameworks and sustained commitment, dramatically improves the impact and sustainability of any FinOps initiative.

Conclusion: Make Every Cloud Dollar Count

Cloud FinOps is no longer optional for enterprises operating at scale. It is essential to turning cloud from a cost center into a strategic growth platform. The market is growing at 11.4% annually, and leading organizations are already capturing 20–30% cost savings while improving governance, security, and agility.

With AI/ML-driven insights, proven industry frameworks, and a managed services delivery model, Sutherland helps organizations achieve rapid, measurable savings while strengthening governance, security, and innovation velocity.

Learn how your organization can achieve similar results—30% cost savings, improved compliance, faster deployments, and stronger operational control.