Key Points

- Private market valuations are shifting as retail participation expands, regulations tighten, and investors push for greater transparency.

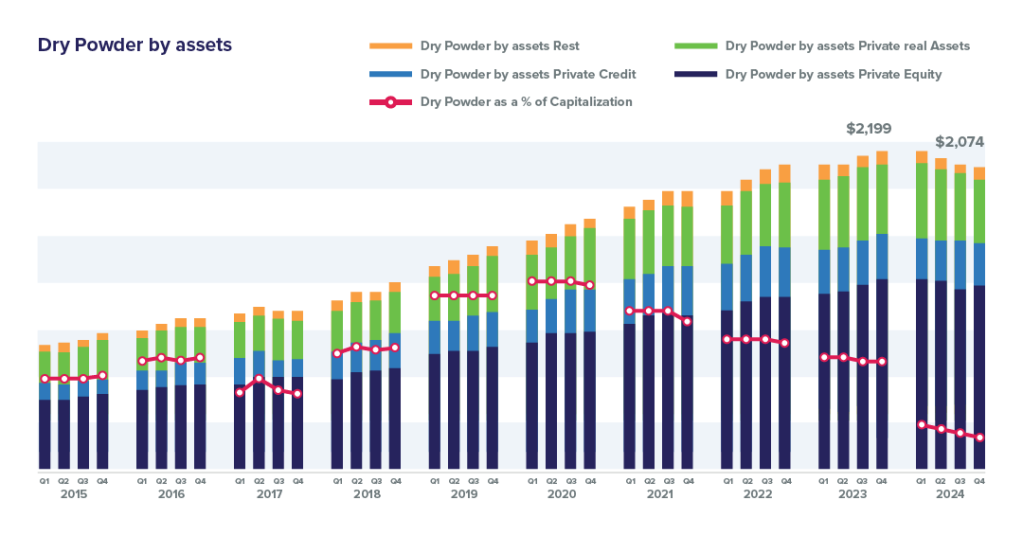

- Fundraising has slowed to $412B in Q2 2025, representing a rough 25–30% decline from earlier run-rate momentum, while dry powder has climbed to nearly $2 trillion—up more than 20% from pre-2023 levels. Yet valuations continue to edge upward as rate stabilization and sector fundamentals support higher marks despite softer capital formation.

- Much of the recent valuation uplift remains subjective because of limited comparables, selective assumptions, and model variability.

- Credible and data-grounded valuations are emerging as the core marker of institutional trust. This shift is converting valuation discipline into a strategic advantage and influencing who leads the private markets landscape.

Interest in private capital has never been broader—retail investors, wealth platforms, and institutions are all expanding their exposure to alternatives. However, this growing participation is bringing new complexity for asset managers.

Fundraising has slowed, dry powder remains high, and every deployment now needs to be explained, benchmarked, and justified. Retail flows are driving greater demand for transparency, while regulators continue to raise the bar on independence and documentation.

The credibility of valuations now sits at the center of investor confidence. It is no longer only about reporting accuracy, but about operational discipline and analytical integrity.

What is Changing in Private Valuations: From Retail Flows to Regulation

The foundations of private market valuation are being reshaped by forces that are simultaneously expanding access and tightening discipline. According to Deloitte, ‘Retailization’, stricter regulation, shifting capital flows, and macro tailwinds are reshaping private valuations—demanding greater transparency, defensibility, and independence as investors and regulators raise the bar.

A. Retailization Reshaping Private Capital Markets

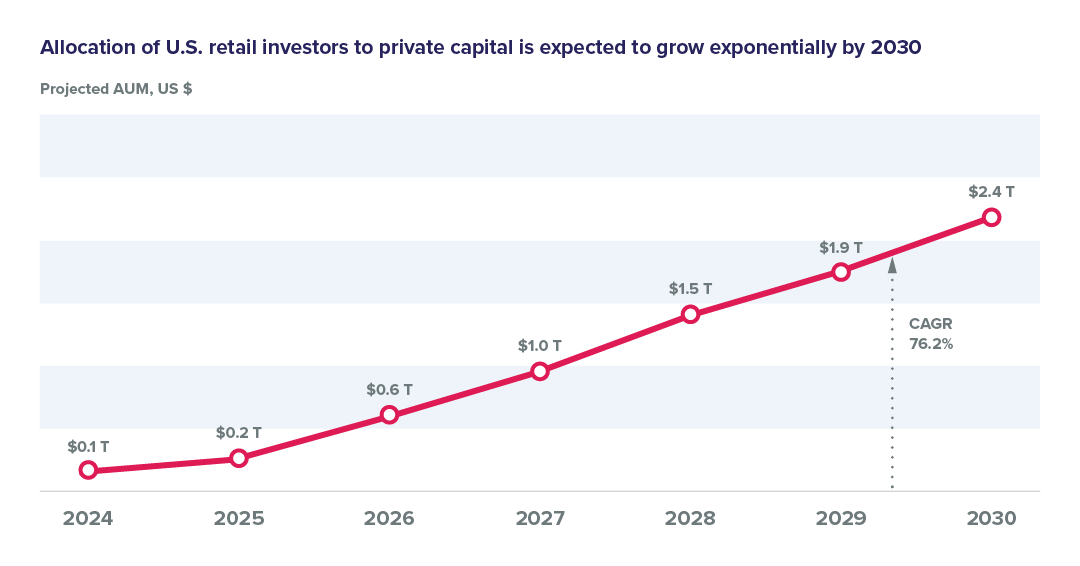

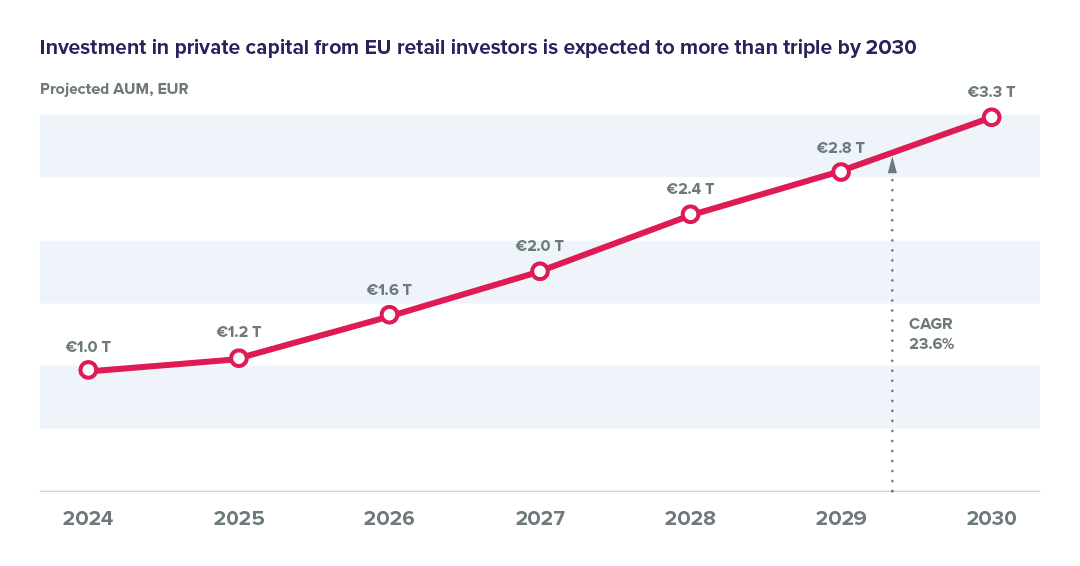

Retail participation in private markets is set to expand dramatically, with U.S. allocations projected to grow from roughly $80B today to $2.4T by 2030, while European retail allocations, currently estimated at around €1T, could exceed €3.3T by 2030—tripling the region’s exposure to private capital. This surge is fueled by investor appetite for diversification, easier access to alternative assets, and the rise of semi-liquid fund structures that enable broader retail entry. As these retail flows accelerate, valuations must evolve from subjective, manager-driven judgment to standardized methodologies where transparency, consistency, and comparability become essential.

B. Regulatory Intensification

Global regulators share one priority: valuations must be independent, transparent, and defensible. New directives worldwide are tightening rules on governance, documentation, and conflicts. The U.S. SEC’s 2025 agenda leads this shift, withfocusing on fairness opinions, adviser-led secondaries, and AI oversight. FCA (UK) and ASIC (Australia) directives echo the same demand for independence and accountability.

Regulatory bodies are no longer merely reviewing outcomes; they are examining the valuation process itself, from data inputs to governance frameworks. Oversight is converting valuation into a consistently monitored, audit-ready function integrated into operational risk management.

C. Capital Selectivity and the Rising Demand for Valuation Discipline

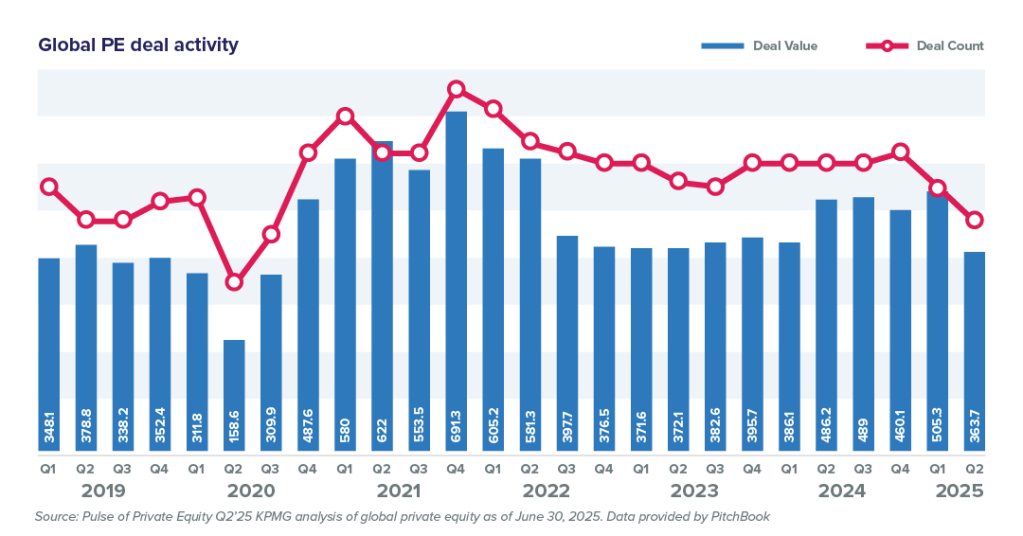

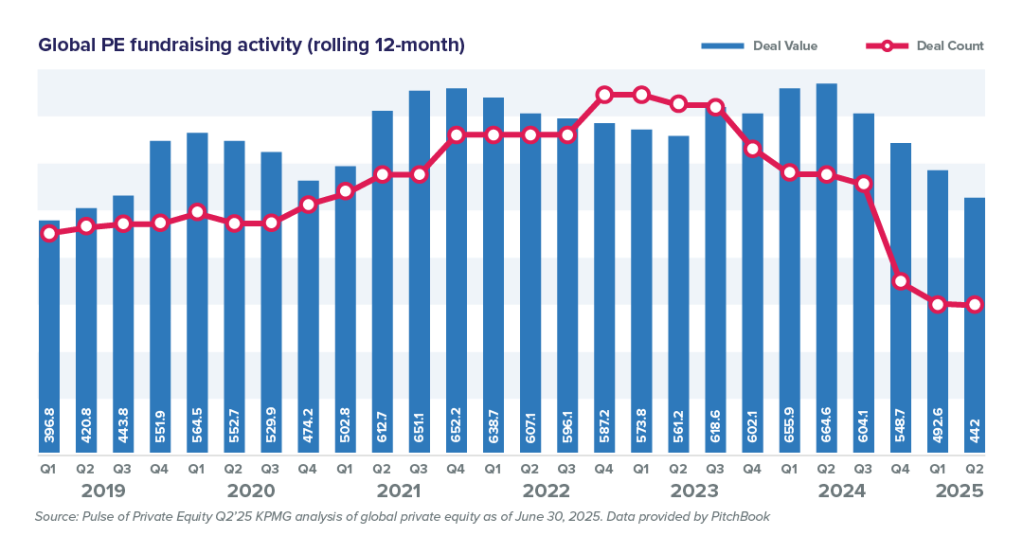

The private markets are operating in a phase of caution where capital is abundant, but deployment is increasingly selective. Global PE fundraising fell to $412B in Q2 2025, according to KPMG, reflecting persistent investor hesitancy, while deal value also declined to $363.7B as managers resist rushing into transactions.

At the same time, MSCI data shows nearly $2T in dry powder sitting on the sidelines, highlighting patience rather than disengagement. With substantial reserves and a slower deal pipeline, managers face intensified scrutiny to ensure that each investment is both price-justified and valuation-defensible.

In this environment, valuation accuracy becomes not just a reporting requirement but a critical determinant of deal conviction and execution timing. Every deployment is now under rising pressure to be defensible, rigorously benchmarked, tightly aligned to relevant comparables, and clearly justified as fairly priced to maintain investor confidence.

D. Valuations Are Rising, but Confidence Remains Uncertain

Valuations are inching higher as macro conditions stabilize, though not all gains stem from fundamentals. Lower rates and stronger cash flows have supported recent marks, yet private equity valuations still carry subjectivity that can quietly inflate asset values.

Morgan Stanley notes that stabilizing rates and cheaper debt are expanding valuation multiples in 2025, while McKinsey reports LP (Limited Partner) distributions recently exceeded contributions (the third-highest on record—signaling improved liquidity).

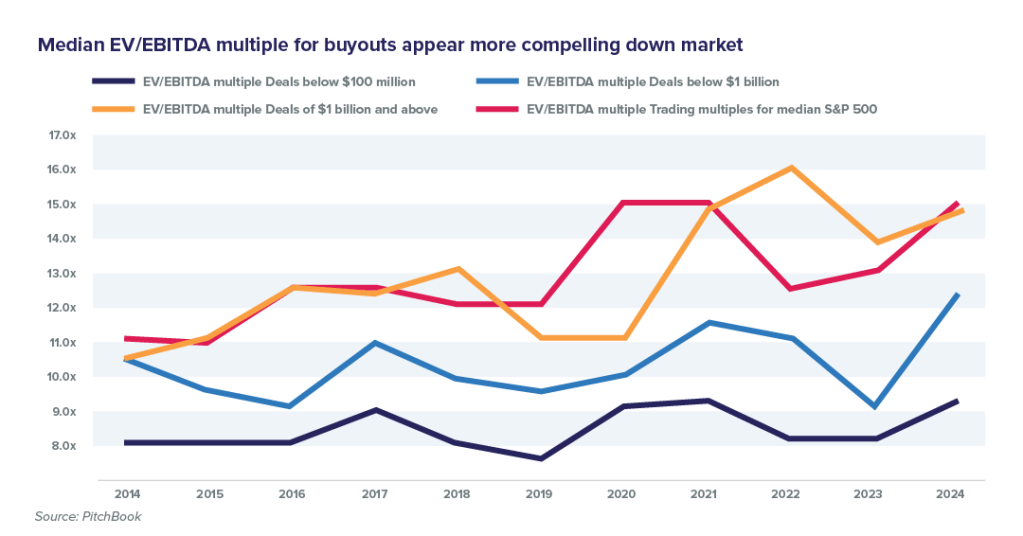

Furthermore, PitchBook data indicates that median EV/EBITDA multiples for large buyouts of $1B or more rose to 15.5x in 2024, narrowing the gap with the S&P 500.

Mid-market deals, however, continue to trade at lower multiples, underscoring the more selective deployment of capital and differentiated risk perception among investors. Yet even with rising multiples, valuation outcomes still rely heavily on underlying assumptions.

Inputs such as discount rates, liquidity adjustments, and peer selection vary meaningfully across firms, resulting in inconsistent NAV calculations. As these valuations trend upward, both regulators and investors are increasingly advocating for standardized and transparent methodologies, supported by independent validation to ensure that asset marks accurately reflect economic value.

With macro conditions supporting higher multiples, stakeholders are demanding clearer assumptions and verifiable rigor in the valuation process. These shifts are reshaping the expectations for transparency and defensibility in private markets. Before firms can fully meet these expectations, they must address the operational gaps and structural inefficiencies that continue to erode valuation confidence from within.

The Core Challenges Undermining Valuation Confidence

Pricing private assets accurately remains difficult due to a combination of opaque disclosures, limited market comparables, inconsistent valuation models, staffing constraints, regulatory pressure, and potential conflicts of interest. These issues collectively make defensible and credible pricing an ongoing challenge for asset managers.

- Illiquidity & Data Scarcity: Few observable transactions force reliance on judgment-based assumptions when markets lack timely comparables.

- Unstructured Data: The manual extraction and fragmented validation of unstructured financials can add hundreds of staff hours and six-figure advisory costs per deal, as firms spend 20–30% more time reconciling data, driving up administrative expenses and slowing valuations.

- Model Inconsistencies: Disparate templates and assumptions across portfolio companies hinder standardization and auditability.

- Talent Bottlenecks: Quarter-end crunches and limited valuation expertise heighten risk around reporting deadlines.

- Conflict of Interest: GP-led secondaries, continuation funds, and NAV lending expose managers to skepticism from LPs and regulators.

These challenges make valuations not only complex, but increasingly exposed to scrutiny from stakeholders who expect evidence-backed pricing rather than subjective judgment

How Private Funds are Transforming their Valuation Operations

Private asset managers are strengthening valuation frameworks to meet investor and regulatory expectations for transparency and consistency.

- Audit-ready Processes: Embeds version control, assumption logs, and audit trails to ensure traceability and defensibility.

- Automation and Scalable Resourcing: Using automation for roll-forwards and data preparation, freeing senior talent for high-value reviews.

- Independent Validation: Establishes clear conflict policies and engages third parties for fairness opinions and scenario testing.

- Standardization & Benchmarks: Adopts uniform templates, aligns with benchmarks (PitchBook, Preqin, CapIQ), and centralizes model governance.

By operationalizing these practices, funds are shifting valuations from subjective estimation toward scientifically defensible analysis.

The Road Ahead: Credibility as the Cornerstone of Private Valuations

Valuation in private markets is no longer a procedural obligation or regulatory checkbox. It has become a strategic differentiator that signals trust, professionalism, and analytical rigor. As retail participation expands, regulatory expectations intensify, and market volatility persists, only firms with disciplined, transparent, and adaptive valuation frameworks will earn investor confidence.

The leaders of tomorrow will embrace standardized methodologies, independent oversight, and technology-enabled validation to elevate valuation accuracy and consistency. In a market where trust directly influences capital access, credible pricing will stand as the essential marker that separates resilient performers from the rest.

Those who value boldly and defend rigorously will define the future of private capital.

Driving Valuation Confidence: How Sutherland Strengthens Private Market Rigor

At Sutherland, we understand that valuation credibility starts with deep domain expertise, built on decades of experience in private markets, regulatory standards, and valuation governance.

Our teams combine that expertise with AI-enabled efficiency, accelerating data processing and validation while preserving professional judgment. This synergy of human insight and digital intelligence ensures that valuation decisions are not only faster, but also contextually grounded and defensible.

By standardizing unstructured data and automating key workflows, Sutherland enables funds to reduce manual processing effort by up to 60% and speed up analytical review by nearly 40%. The result is a valuation function that is more consistent, more transparent, and more resilient under audit.

Beyond automation, we help clients create valuation environments that are audit-ready, version-controlled, and fully traceable, allowing for real-time collaboration across finance, front office, and risk teams. Our approach drives tangible digital outcomes, leading to informed investment decisioning.

AI provides the scale and velocity. Our domain-led methodology provides accuracy and judgment. Together, they ensure that every valuation produced under Sutherland’s framework is defensible, standardized, and trusted by stakeholders across auditors and regulators alike.