Private Equity is Entering a New Era—Faster, Smarter, and Radically More Transparent

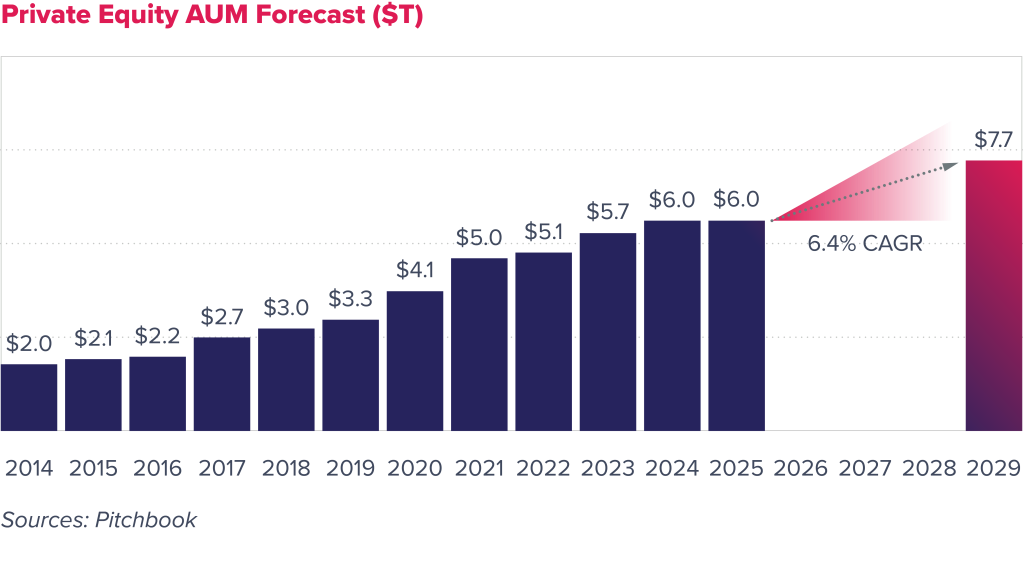

Once a quarterly-reporting, spreadsheet-reliant world, portfolio management is now at the epicenter of transformation. Fueled by rising investor expectations, ESG imperatives, and a surge of institutional capital, PE firms are being pushed to evolve—or risk falling behind. As per PitchBook, between 2020 and 2025, PE AUM soared close to 50%, reshaping the industry’s scale and complexity.

Today, private equity firms are expected to operate with the transparency, speed, and reporting rigor of public markets—yet they must do so with private companies’ fragmented, often elusive data.

Gone are the days of static reports and siloed data. Today’s portfolio managers need real-time visibility, automated insights, and AI-driven precision across continents, asset classes, and stakeholder demands. This shift isn’t optional; it’s foundational to staying competitive.

What’s Driving the Change in Portfolio Management?

1. Rising AUM and Firm Size: According to PitchBook, Private Equity AUM is projected to reach $7.7 trillion by 2029—underscoring the urgent need to shift from unstructured, intuition-led models to scalable, data-driven processes.

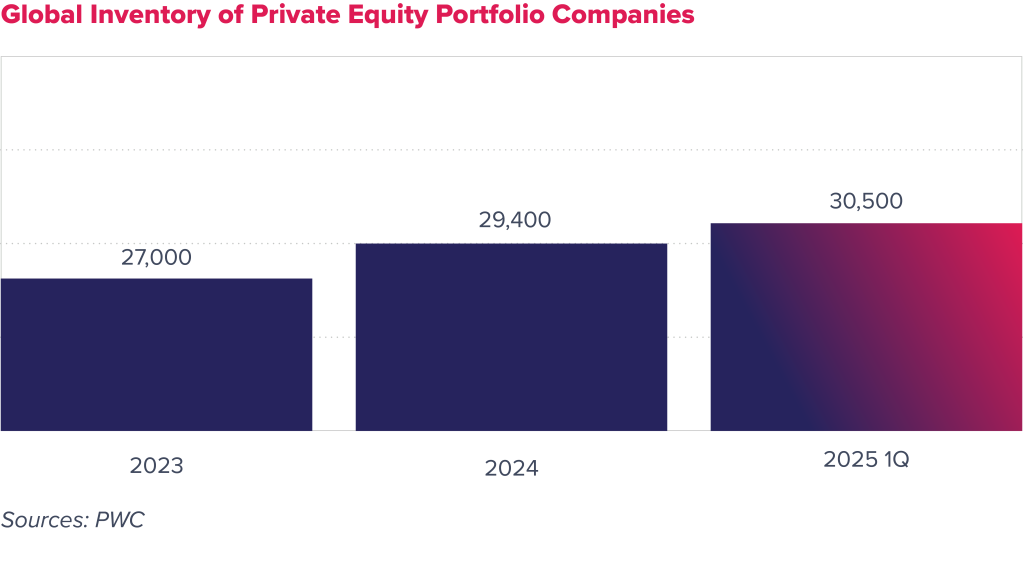

2. Larger, More Diverse Portfolios: According to PwC, as fund sizes grow and holding periods extend, the number of portfolio companies is rising—demanding dynamic, real-time oversight and sophisticated risk assessment to manage these expanding investments effectively.

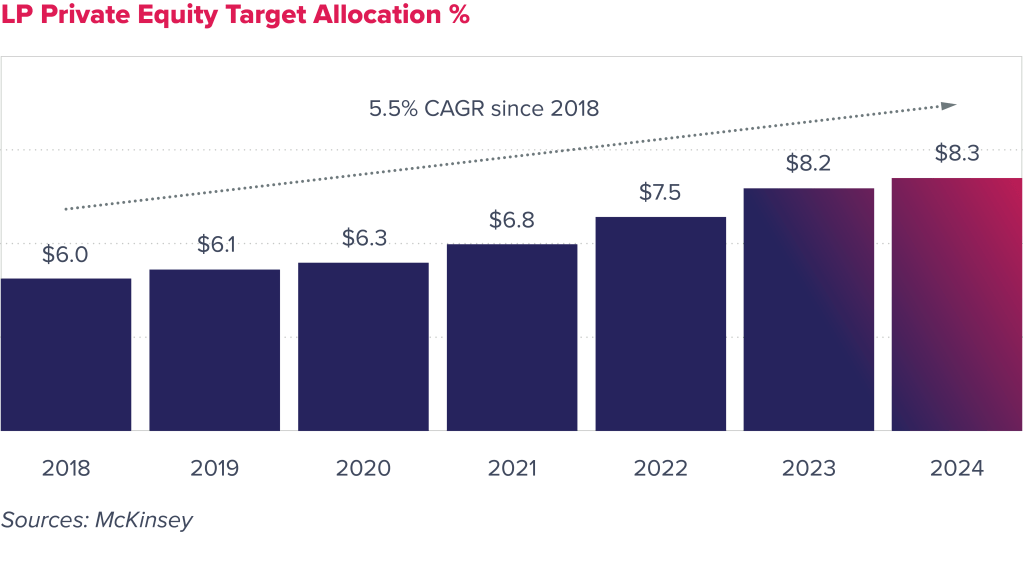

3. Increased LP Participation and Expectations: McKinsey believes that since 2019, limited partners (LPs) have steadily raised their target allocations to PE. As investor profiles become more diverse, expectations rise, demanding greater transparency, more frequent reporting, and stronger performance accountability.

How is PE Portfolio Management Evolving as a Result of It?

Rising AUM, larger portfolios, and more demanding LPs have led to a transformation from static, spreadsheet-based reviews to dynamic, tech-enabled, and investor-aligned portfolio management. PE firms are building systems not just to report, but to anticipate, optimize, and communicate value across growing, complex portfolios.

Key Shifts in Portfolio Management:

- Centralization & Scalability

- Centralized tools provide visibility across sectors and geographies

- Data is consolidated into unified “sources of truth”

- Real-Time Data Collection & Dashboards

- Automated pipelines deliver real-time financials from portfolio companies

- Dashboards track KPIs: cash flow, covenants, operating metrics

- Cross-portfolio benchmarking, alerts improve proactive decision-making

- Higher-Frequency and Custom Reporting

- LPs now expect monthly or event-based reporting updates

- Reports include ESG data, risks, and LP-specific formats

- Portfolio Value Creation

- Embed structured value creation plans (VCPs)

- Track value creation levers; pricing, cost, margin, digital levers

- Integrate fund level data to make informed, firm wide decisions

What Makes This Shift Challenging?

As their portfolio expands, staying ahead is harder for the PEs—outdated systems, inconsistent data, complex reporting needs, and rising ESG and investor demands all make transforming portfolio management a real operational challenge.

Key Challenges:

- Lack of Standardization: Non-uniform data formats complicate consolidation and comparison

- Timeliness & Accuracy: Delayed, manual inputs lead to stale or error-prone reporting

- Resource Burden: Meeting diverse LP demands strains internal teams

What Tools and Solutions Are Helping PEs Bring About This Change?

Based on Sutherland’s firsthand work with leading private equity firms, the following solutions—backed by our internal data and proven outcomes—are helping funds modernize their operations and outperform in a complex landscape.

To keep pace, and excel, the funds need smarter tools—automated data extraction, a unified data foundation, and real-time dashboards that simplify analysis, streamline reporting, and free their team to focus on value.

- Automate Data Extraction from Unstructured Sources

- OCR and NLP extract data from non-standard filings, improving reporting speed by 60%

- Rule-based QC detects anomalies in revenue and margin trends

- Build a Centralized Unified Data Foundation

- Integrated pipelines aggregate data from Excel, Snowflake, and internal sources—cutting collation time by 80%

- Machine learning normalizes financial terms like EBITDA across datasets

- CI/CD pipelines enable scalable, secure analytics deployment

- Visual, Automated Reporting

- Drag-and-drop KPI tools cut modeling time by 30%

- Dashboards show real-time financials, ESG KPIs in Tableau/Power BI

- LLMs draft memos, generate personalized LP reports automatically

- Connected Intelligence for PVC

- Integrate portfolio, fund, and deal-level data

- Use AI/ML to benchmark, flag risks, predict underperformance

- Track org design, leadership quality, and hiring metrics

Conclusion

Private equity is at an inflection point. What was once a quarterly-reviewed, opaque asset class is evolving into a dynamic, tech-enabled platform. To lead in this next chapter, firms must move beyond standalone portfolio monitoring and integrate it with fund-level data, capital calls, waterfalls, and deal models. This holistic view empowers smarter, firm-wide decision-making. With the right tools and partners, forward-thinking firms are not just managing investments—they’re building intelligent infrastructure. With the right tools and partners, the future of portfolio management is not just possible—it’s already here.

AI-Driven Transformation: How Sutherland Empowers PE funds

Sutherland’s AI-powered portfolio management solution has helped our Private Equity clients accelerate insights and decision-making by automating the performance monitoring lifecycle. It uses OCR and NLP to extract unstructured data into automated pipelines, reducing extraction time by 60% and improving traceability.

ML-based templates have helped our clients standardize metrics across 50–100+ formats, cutting errors by 70% and tripling analysis speed. This data powers Tableau/Power BI dashboards with real-time feeds and benchmarking, enabling early alerts and 30% faster access to KPI insights.

GenAI tools automate LP reporting, flag anomalies, and centralize ESG and risk tracking—saving up to 40% of reporting time. Smart dashboards also track value creation initiatives, driving transparency and better alignment with operating teams.