The insurance industry is undergoing a seismic shift, and nowhere is this more evident than in claims processing. With AI-powered claims automation and Gen AI-driven intelligence, rapidly transforming workflows, insurers are moving from reactive claims management to a proactive, intelligent model that enhances efficiency, customer experience, and cost control. Watch the full webinar here.

The State of Claims in 2025: What’s Changing?

According to Everest Group’s research, insurers are prioritizing AI-driven claims management enhancements to improve claims handling quality and reduce losses. Ronak Doshi, Partner at Everest Group, highlighted that technology investments are now focused on:

- Reducing claims volume through predictive analytics and safety interventions

- Improving customer experience with AI-driven triage and self-service tools

- Empowering adjusters with automation to eliminate manual tasks

48% – Usage of tech for modernizing claims management solution

35% – Enhance customer experience

7% – Adopt cloud-enabled /connected platforms

4% – Transform the operating model

4% – Reduce loss-adjustment expenses

2% – Leverage ecosystem and unstructured data

The shift from traditional, paper-intensive claims handling to AI in insurance models is no longer a futuristic vision—it’s a necessity. The challenge now is integrating AI in claims processing into legacy systems without major disruptions.

Overcoming Legacy System Challenges: A Pragmatic AI Adoption Model

Many insurers struggle with outdated systems that hinder digital transformation. However, as Ashi Baghdadi, VP of P&C Insurance at Sutherland, explained, AI adoption doesn’t require a complete overhaul. The Crawl-Walk-Run approach enables insurers to implement AI in insurance operations incrementally:

- Crawl: Automate basic tasks like document reading and claims routing

- Walk: Integrate AI into decision-making while keeping human oversight

- Run: Fully automate straightforward claims, allowing adjusters to focus on complex cases

| Phase | Focus Area | Al Use Case | Sutherland Platform Leveraged | Integration Effort |

|---|---|---|---|---|

| Crawl | Foundation, low-risk tasks | OCR, classification, routing | Extract. Ai, Robility | Minimal |

| Walk | Expansion, human-in-the- loop | Fraud detection, preliminary decisioning, collaboration with wrappers | SUL, Robility | Moderate |

| Run | Full-scale integration, advanced automation | End-to-end automation, NLP, predictive analytics | Connect, SUL, Robility | High |

This method minimizes risks while ensuring seamless AI integration. As Michael Krikheli, Co-founder and CTO of Five Sigma, noted, “New AI technologies allow insurers to leapfrog traditional integration hurdles by ingesting and interpreting unstructured data directly from legacy systems.”

AI-Powered Straight-Through Processing: Reality or Hype?

While Straight-Through Processing (STP) is the gold standard, survey data from the webinar showed that:

- 45% of insurers achieve only 0-10% STP

- 18% achieve 20% STP

- The industry believes 60-70% STP is achievable in the near future

Barriers to full automation include legacy infrastructure, regulatory complexities, and non-standardized claims. However, leading insurers are achieving 40% STP through AI-driven workflows, fraud detection, and smart decisioning systems.

AI’s Role in Indemnity Cost Optimization and Fraud Prevention

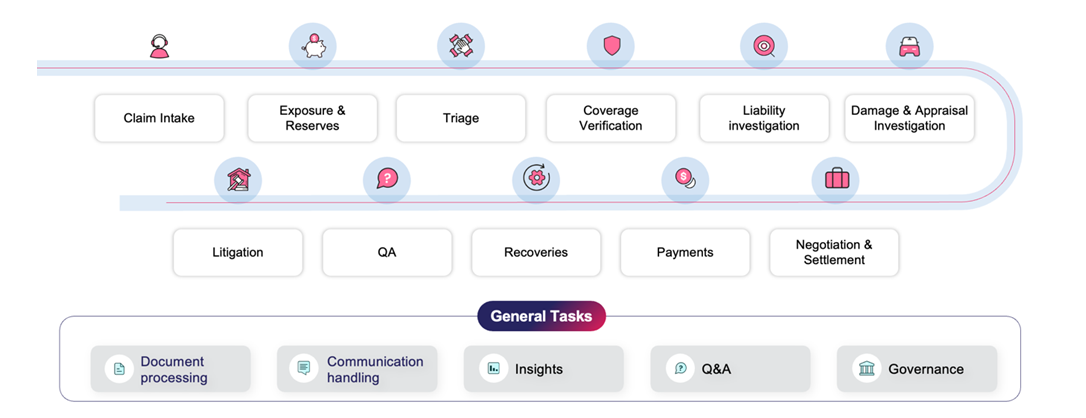

AI is revolutionizing claims handling at every step. Here are some of the most impactful use cases:

- Fraud detection: AI-driven text analytics and image recognition identify suspicious claims in real time

- Automated liability decisions: NLP extracts liability details from legal documents and claims narratives

- Intelligent subrogation: AI predicts high-recovery claims early, boosting financial outcomes

Sutherland’s CognilinkClaims is an AI-fueled claims management solution that has delivered 15% indemnity cost reduction, 40% straight-through processing improvement, and 10-point NPS growth for leading insurers.

Augmenting, Not Replacing, Human Decision-Making

Contrary to popular fears, AI is designed to enhance adjusters’ expertise, not replace them. Michael Krikheli emphasized, “Adjusters no longer need to sift through 1,000-page reports. AI summarizes the insights, allowing them to focus on critical decision-making.”

Claims teams are moving towards a human-AI collaboration model, where AI assists in routine processing while humans oversee complex cases, negotiations, and customer interactions.

Ensuring AI Compliance and Transparency in Claims

As AI takes on a greater role in claims decisions, regulatory scrutiny is intensifying. Insurers must implement governance frameworks that include:

- Human oversight in AI-driven decisions

- Bias detection audits to ensure fairness

- Traceability mechanisms for AI-driven settlements

AI governance isn’t just about compliance—it’s essential for maintaining customer trust and regulatory alignment.

Measuring AI Success: What Really Matters?

To evaluate the impact of AI in claims processing, insurers must track key metrics across three dimensions:

- Efficiency: Reduction in claims cycle time (e.g., moving from 3 days to 3 hours)

- Effectiveness: Lower indemnity costs and fraud losses

- Experience: Improved customer satisfaction and adjuster productivity

AI is already enabling insurers to achieve:

20-35% – Faster claims processing

15-35% – Cost reductions

10-20% – Improvements in customer satisfaction

The Road Ahead: AI as a Strategic Differentiator

As insurers move beyond automation into true AI-driven decision-making, the focus will shift from cost savings to customer-centric transformation. Gen AI in claims is not just streamlining processes—it’s redefining the entire claims experience.

For a deeper dive into how AI in insurance is accelerating claims from FNOL to settlement, watch the full webinar here.