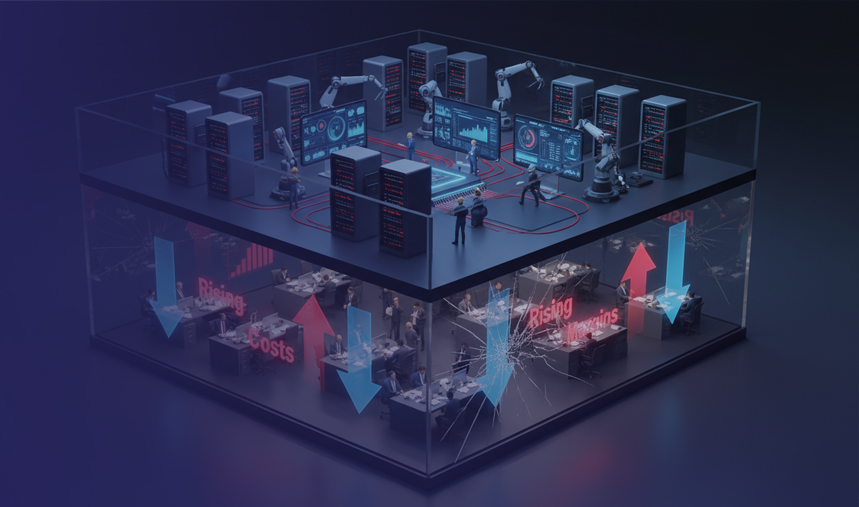

Banks today are spending billions just to keep outdated systems running—an expensive trap that’s stifling innovation and slowing digital transformation. With 70–80% of IT budgets tied up in legacy maintenance and over 30 weeks needed to launch new products, traditional institutions are falling behind agile fintech competitors. The result? Missed opportunities, fragmented customer experiences, and mounting regulatory risk.

Enter composable banking: a modular, API-first approach designed to liberate banks from their legacy burdens. By replacing rigid core systems with flexible, AI-enabled components, banks can cut IT operating costs by up to 60%, halve their time-to-market, and personalize services at scale.