Fraud in consumer lending is a persistent challenge, one that has evolved alongside the lending industry itself. From personal loans to credit cards and auto finance, the very systems designed to bring convenience and opportunity to consumers have also opened doors for cunning fraudsters. The question, then, is not whether fraud will occur—but how financial institutions can stay one step ahead. And in the right corner we have (AI), a game-changer in the fight against fraud.

The Shape-Shifting Threat of Fraud

Picture this: A borrower applies for a personal loan online. The application appears legitimate, the documentation checks out, and approval is swift. Months later, the lender discovers the borrower doesn’t exist. This is synthetic identity fraud, one of the fastest-growing types of fraud in consumer lending.

According to McKinsey, synthetic identity fraud alone accounts for 10-15% of charge-offs in the United States, costing lenders an estimated $6 billion annually.

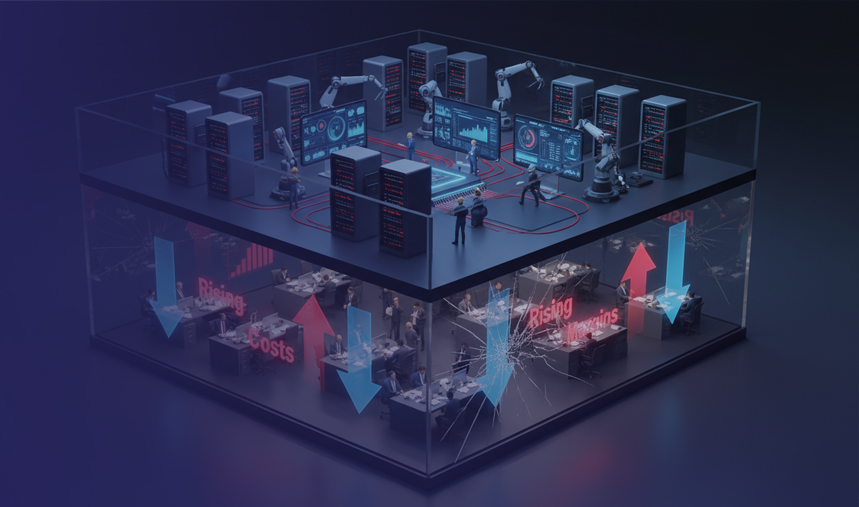

Fraud today is as dynamic as the industry it targets. Fraudsters leverage stolen personal data, fabricate identities, and exploit gaps in digital systems with alarming sophistication. For financial institutions, the stakes are immense: losses measured in billions, damaged reputations, and, most importantly, compromised customer trust. The traditional rule-based fraud detection systems that served well in the past are no longer enough to combat these modern threats.

A New Era: AI in Fraud Detection

Artificial intelligence is rewriting the narrative for fraud detection. Unlike static systems that follow a pre-set playbook, AI thrives on adaptability. It’s the vigilant analyst, the tireless detective, and the adaptive learner, all rolled into one.

1. Decoding Patterns Through Machine Learning

Think of machine learning (ML) as a storyteller adept at weaving patterns from endless volumes of data. ML doesn’t just identify anomalies; it learns from them. Whether it’s unusual spending behavior on a credit card or inconsistencies in a loan application, ML models identify the signals that might escape even the sharpest human eyes.

2. Real-Time Detection: The Need for Speed

In consumer lending, time is of the essence. Customers expect instant approvals, and fraudsters exploit these high-speed processes. AI works in milliseconds, analyzing application data, historical records, and external databases to flag suspicious activity before money changes hands. Juniper Research estimates that AI-based fraud prevention systems could save banks and financial institutions $10 billion annually by 2027 through faster, more accurate detection.

3. Unmasking Synthetic Identities

Synthetic identity fraud is like a masterful illusion—a blend of real and fake data crafted to deceive. AI excels at connecting the dots, cross-referencing data across sources to expose inconsistencies. What might look like a credible borrower to a manual reviewer is unmasked by AI as a digital phantom.

4. Detecting Forgery with Precision

A forged document may fool the human eye, but not AI. Using image recognition algorithms, AI scrutinizes every pixel, every font variation, and every suspicious alteration to detect forgery with unparalleled accuracy. According to a study by IDC, AI-powered fraud detection systems can enhance detection accuracy by up to 70%, significantly reducing false positives compared to traditional rule-based systems.

5. The Power of Language: NLP in Action

Words can reveal as much as actions. Natural Language Processing (NLP) analyzes the language in loan applications, email communications, and even social media posts. A mismatch in tone or inconsistencies in written information can be the breadcrumb trail that leads to a fraudster.

6. Mapping the Fraud Web

Fraud isn’t always an isolated act; it’s often part of a network. AI leverages graph analytics to uncover relationships between accounts, devices, and transactions, revealing the web of connections that underpin organized fraud schemes.

Why AI Matters More Than Ever

The benefits of AI in fraud detection aren’t just operational; they’re transformational.

| Enhanced Precision | AI reduces false positives, sparing genuine customers from unnecessary scrutiny. |

| Faster Decisions | Real-time analysis keeps pace with consumer expectations. |

| Cost Savings | By automating detection and minimizing fraud losses, AI improves the bottom line. |

| Seamless Scalability | AI scales effortlessly with growing transaction volumes |

| Evolving Intelligence | AI models keep improving over time, learning from each attempt to outwit them. |

Hurdles in the AI Journey

Every progressive technology comes with its challenges, and AI is no exception:

- Data Integrity: High-quality data is the bedrock of effective AI. Poor or fragmented datasets can undermine even the most sophisticated models.

- Regulatory Compliance: Transparent AI decisions are essential to meet regulatory standards and maintain customer trust.

- Legacy Systems: Integrating AI into dated infrastructures presents significant technical complexities.

- Fraudsters’ Counter-Adaptive Strategies: As AI evolves, so too do the methods of its adversaries, necessitating relentless updates and vigilance.

Envisioning the Future of Fraud Detection

The horizon for fraud detection is illuminated by proactivity and foresight. Imagine AI systems forecasting fraud trends, preempting vulnerabilities, and safeguarding both institutions and consumers. Innovations like federated learning, which enables collaborative model training across decentralized data sources while preserving privacy, will redefine industry collaboration. Together, these advances pave the way for a united front against fraud.

Closing Thoughts

Fraud detection in consumer lending transcends technology; it is a matter of integrity and trust. In an industry built on reputational capital, the ability to anticipate and thwart fraud is paramount. Artificial intelligence doesn’t merely detect fraud—it narrates the story of its genesis, evolution, and resolution, empowering lenders to act decisively and restore faith.

The fight against fraud is unceasing, but with AI as their ally, lenders can turn this challenge into an opportunity. By leveraging AI’s transformative power, financial institutions can ensure that consumer lending not only remains secure but also fosters confidence and growth in an ever-evolving digital landscape.