We’re all discussing transforming processes and systems to elevate customer experience, enhance operational efficiency, and boost organizational success. But, what’s the key to getting it right?

The compliance operations are seen more as a burden of doing business. More often than not, they work in silos, with their disparate processes and different priorities than typical banking business of garnering more business, retaining and delighting customers. Breaking this figurative mould and revisiting possibilities of enhancing compliance operations while aligning to overall business values, here is a webinar which tells us how and what of this approach.

Listen to Sutherland’s head of BFS Customer Success, Sumit Chopra, in conversation with Director of FinScan Advisory Services Stephen Marshall in our recent webinar. Stephen is an expert compliance and internal audit experience and he shares insights on how to build a comprehensive risk management strategy for AML compliance. While Sumit shares his managed services operations experience on how AI driven analytics, process excellence and understanding risk to better manage KYC and AML functions which can lead to better CX, reduce cost and drive business growth.

Let’s recap:

Navigating AML Compliance: Balancing the Pros and Cons

Stephen highlights the inherent challenges in pursuing value from AML compliance operations, shedding light on what to be mindful of despite the apparent benefits:

- A Complex Regulatory Landscape: AML regulations and requirements not only vary across jurisdictions but are constantly evolving. It is challenging to navigate this complex landscape effectively – and to avoid hefty fines associated with non-compliance.

- Delivering Better Customer Experience: Achieving the perfect balance between risk mitigation and fulfilling KYC requirements is difficult. It can also often inconvenience legitimate customers, leading to dissatisfaction.

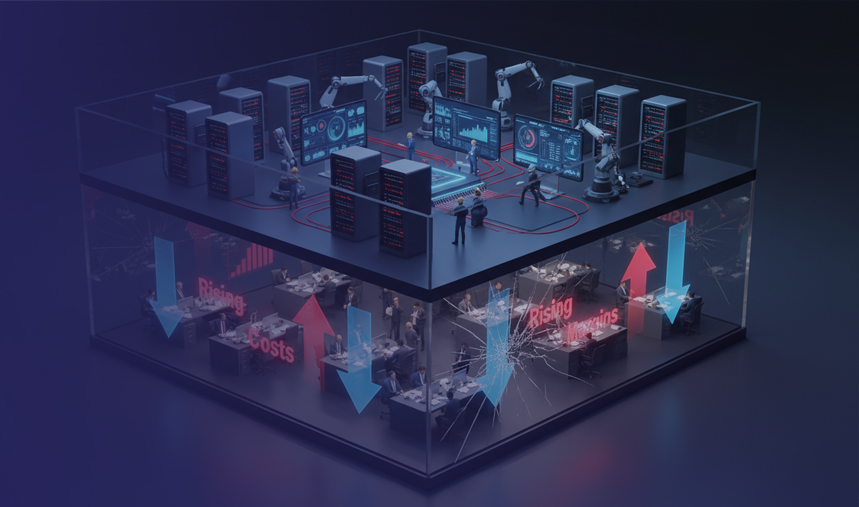

- Addressing Rising Costs: AML compliance costs have steadily increased due to demand for advanced technology, heightened monitoring, and expanded staff to align with regulatory standards. Enhancing efficiency and integration is vital to addressing this challenge.

- Tackling Operational Inefficiencies: Siloed processes and systems within organizations often lead to operational inefficiencies. This makes it challenging to gather holistic customer information and accurately assess risk.

Data Quality Excellence

In this regard, Sumit and Stephen highlighted three key factors for success:

According to Stephen customer experience is the core of your growth journey, in compliance operations, data quality is paramount—it forms the cornerstone for reliable insights, informed decision-making, and operational success. Accurate, consistent data underpins trustworthy analytics, fostering a robust foundation for successful business operations in a data-driven world.

- Holistic Data Gathering: It is critical to have a mechanism for comprehensive collection of information from various sources. This approach will ensure data driven insights and understand customer behaviour, enabling informed decision-making for enhanced business growth and elevate CX.

- Dynamic Learning: Modern AML systems need dynamic learning capabilities. This supports real-time data analysis, prediction, and adaptation, helping you to recognize any emerging risks and quickly adjust to changes.

- Better Data Quality: Data quality is crucial to meet regulatory requirements and minimize the risk of penalties or sanctions. With regulations changing frequently, you need an agile, vigilant system capable of staying ahead.

How Can You Ensure Both the Quantity and Quality of Data?

Choose versatile, tech-driven AML/KYC systems for seamless integration. Strengthen the link between AML functions and customer interactions, empowering sales and client teams to anticipate needs. For customers, it translates to an enhanced experience—no more redundant requests, faster access to desired products.”

It is Time to Reinvent AML

Managed services for KYC/AML streamline compliance by outsourcing regulatory tasks to specialized providers. Sumit spoke about a framework where the intelligent automation solution, optimizing data collection, reducing false positives, and revolutionizing AML/KYC compliance bring about a continuous monitoring, data verification, and risk assessment, enhancing accuracy and efficiency.

Leveraging expert services, businesses can navigate complex compliance landscapes, reduce costs, and maintain a robust framework for KYC/AML requirements.

Looking Beyond Checkbox Compliance

Revamping your AML risk management is vital for dismantling siloes and tapping into revenue-generating opportunities. A customer-first approach is not just a best practice but a strategic imperative to move beyond checkbox compliance.

To achieve this, integrate compliance practices seamlessly into core business strategies. Leverage data-driven insights and adopting innovative models with a customer-first mindset. In doing so, AML compliance can transform into a pivotal business asset. Its systems can make it easier to collaborate with other departments, achieving shared goals and establishing compliance as a foundational layer for business success.

Catch up on our webinar to learn directly from the experts.

Ready to turn your AML operations from a business constraint to a value driver? Get in touch to see how Sutherland can support your customer-centric transformation.