The financial services industry is stepping into a new era—one where AI and hyperautomation are redefining how banks and financial institutions operate. This isn’t just about incremental efficiency gains anymore. Wave 2.0 of AI in BFS is about autonomous decision-making, self-learning AI agents, and intelligent augmentation of human expertise.

A staggering 70% of banking and financial services firms see automation as critical for future growth, but challenges like outdated infrastructure, regulatory complexities, and fragmented data ecosystems continue to hinder AI adoption and slow transformation.

In our latest webinar with BFS industry leaders, we tackled these pressing issues—unpacking strategies to overcome barriers, implement next-gen automation frameworks, and drive true operational excellence.

Breaking Down the Barriers: What’s Holding BFS Firms Back?

Despite widespread AI adoption, BFS firms face five key roadblocks: legacy infrastructure that limits scalability, regulatory complexities that hinder AI governance, fragmented data that slows decision-making, a shortage of AI talent, and organizational resistance to change.

Legacy Systems: 75% of banks report difficulties implementing new payment solutions due to outdated infrastructure. Many still run COBOL-based mainframes that cannot natively support AI-driven workflows.

Regulatory & Compliance Complexities: With the EU AI Act, stricter AML/KYC regulations, and AI fairness requirements, financial institutions are facing increasing scrutiny on their AI governance frameworks.

Data Silos & Fragmentation: 92% of financial firms still rely on legacy data infrastructure, limiting AI’s ability to deliver insights and real-time decision-making.

Talent Shortages: The demand for AI expertise far outweighs supply, making it difficult for BFS firms to build in-house AI capabilities. No-code AI solutions and AI-driven process mining tools are emerging as solutions.

Cost & ROI Uncertainty: Many BFS leaders cite long AI implementation cycles and high upfront costs as barriers to scaling automation initiatives. However, modular AI adoption via Agentic AI frameworks is proving to be a game-changer.

The Future of AI in BFS: From Automation to Agentic AI

Traditional RPA-driven automation focused on rule-based tasks and efficiency improvements. Agentic AI, however, introduces an entirely new paradigm—where AI agents can perceive, reason, plan, and autonomously execute decisions with minimal human intervention.

Autonomous Decision-Making: AI agents can handle end-to-end KYC compliance, fraud detection, and credit underwriting without human intervention.

Self-Learning & Evolution: Unlike traditional bots, Agentic AI models continuously refine risk models, optimize lending decisions, and dynamically adapt to compliance updates.

Augmenting Human Decision-Making: AI doesn’t replace banking professionals; instead, it elevates their capabilities by handling low-value, high-volume tasks, allowing employees to focus on complex cases and strategic initiatives.

Below are some key AI-fueled automation opportunities for BFS organizations:

Real-World Impact: How AI is Reshaping BFS Operations

AI is transforming BFS operations beyond efficiency gains—enabling autonomous decision-making, intelligent automation, and seamless customer experiences. From streamlining compliance to optimizing financial workflows, discover how AI is driving tangible results and redefining the future of banking.

Loan Processing Optimization: A leading bank implemented AI-powered document intelligence to accelerate loan approvals from weeks to minutes, reducing underwriting errors and enhancing compliance.

Automated Credit Dispute Management: A top 10 US card issuer leveraged Sutherland FinTelligent to deploy 120+ AI-powered bots that handle credit disputes with 99.5% accuracy, reducing manual intervention by 60%.

KYC Compliance Automation: A global payments company streamlined identity verification, achieving:

- 40% improvement in fraud detection

- 75% reduction in manual effort

- 95%+ accuracy in identity verification using Agentic AI-driven KYC workflows

AI-Powered Risk & Compliance: BFS firms using AI for regulatory risk assessment report a 20-30% improvement in compliance efficiency, thanks to predictive AI models that detect early warning signs of fraud.

Sutherland FinTelligent: AI-Powered Transformation for BFS

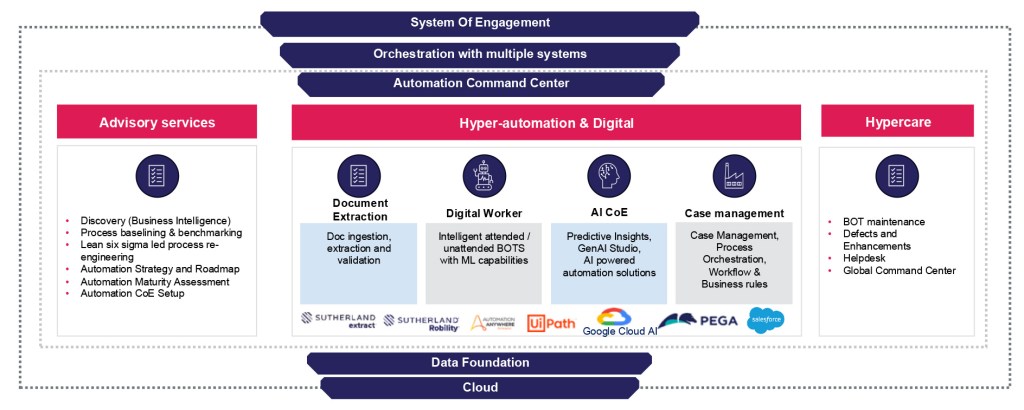

Sutherland FinTelligent is a next-generation AI-driven hyperautomation suite designed to help BFS enterprises accelerate transformation, enhance security, and elevate customer experiences. By integrating agentic AI, cognitive automation, and intelligent orchestration, FinTelligent empowers financial institutions to operate with greater agility, precision, and scalability.

Agentic AI Orchestration: Autonomous, self-learning AI agents that dynamically execute and optimize complex banking workflows, reducing manual intervention.

AI-Powered Fraud Detection – Advanced risk analytics and real-time anomaly detection, ensuring proactive fraud prevention in high-risk transactions.

Conversational AI & Virtual Agents: Intelligent, context-aware AI assistants delivering hyper-personalized customer interactions across digital banking channels.

End-to-End Hyperautomation: A seamless convergence of AI, RPA, and cognitive automation, creating an intelligent, self-optimizing ecosystem that drives operational excellence and resilience.

With BFS leaders facing pressure to cut costs, improve compliance, and elevate customer experience, solutions like Sutherland FinTelligent are providing tangible business value and measurable ROI across the financial ecosystem.

The Road Ahead: What’s Next for AI in BFS?

The BFS industry is rapidly shifting toward autonomous banking ecosystems powered by Agentic AI. Over the next few years, expect:

- Full-Scale AI Infusion: AI agents managing risk assessment, lending decisions, fraud analytics, and AML compliance with minimal human oversight.

- Hyper-Personalization: AI-driven banking experiences tailored to individual customer needs, preferences, and financial behaviors.

- Regulatory AI & Governance: AI frameworks ensuring financial institutions stay compliant while accelerating AI innovation.

- Embedded AI within Core Banking Systems: Instead of patchwork AI adoption, banks will embed AI natively into their operational DNA.